September 17th: Insured and Assured

St. Matthias’ was officially founded as a mission of St. George’s, Place du Canada, in 1873, which means our community is 150 this year! For the next 12 months, we’ll be diving into the archives to shine the spotlight on particularly interesting parts of our history.

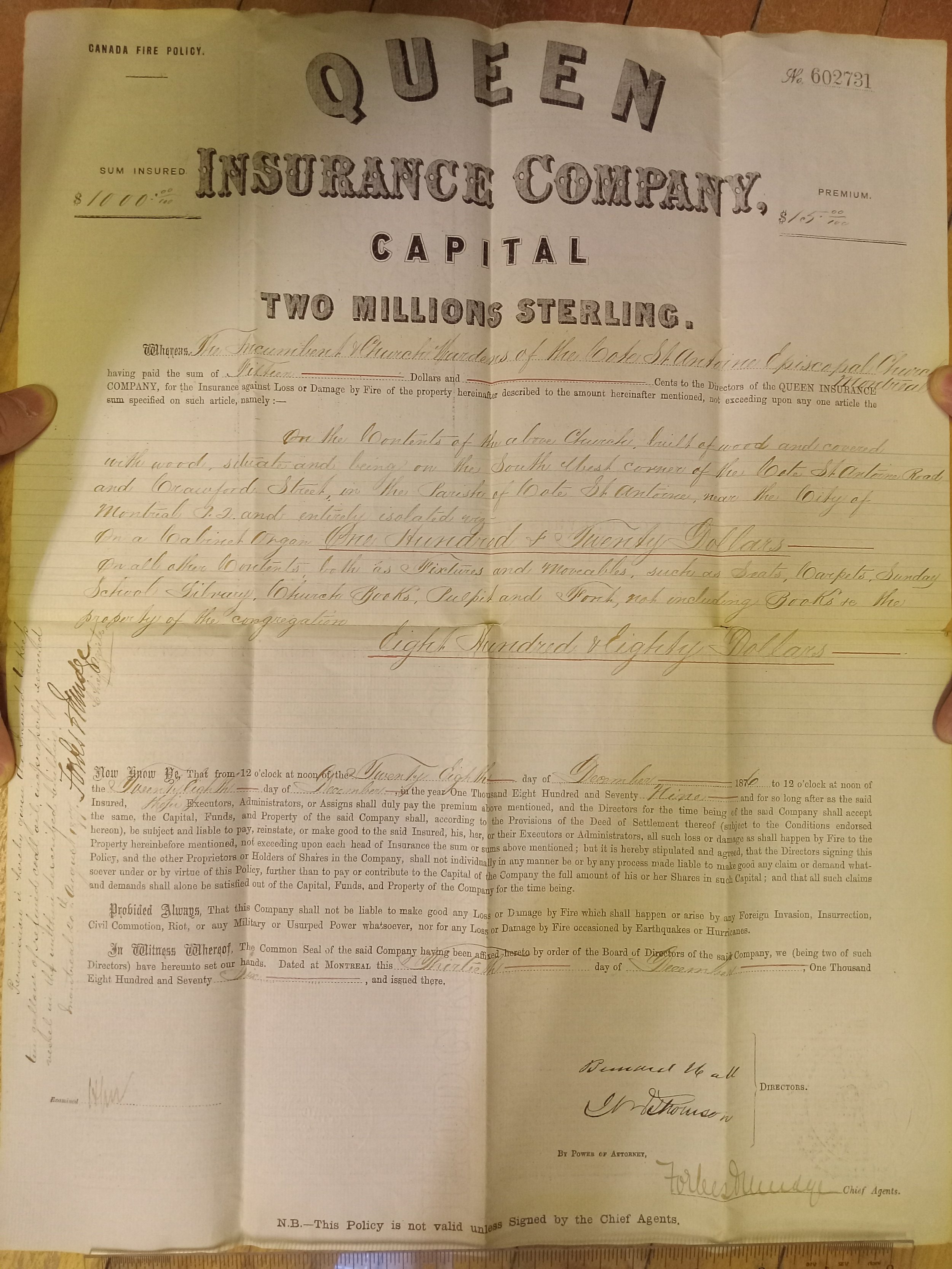

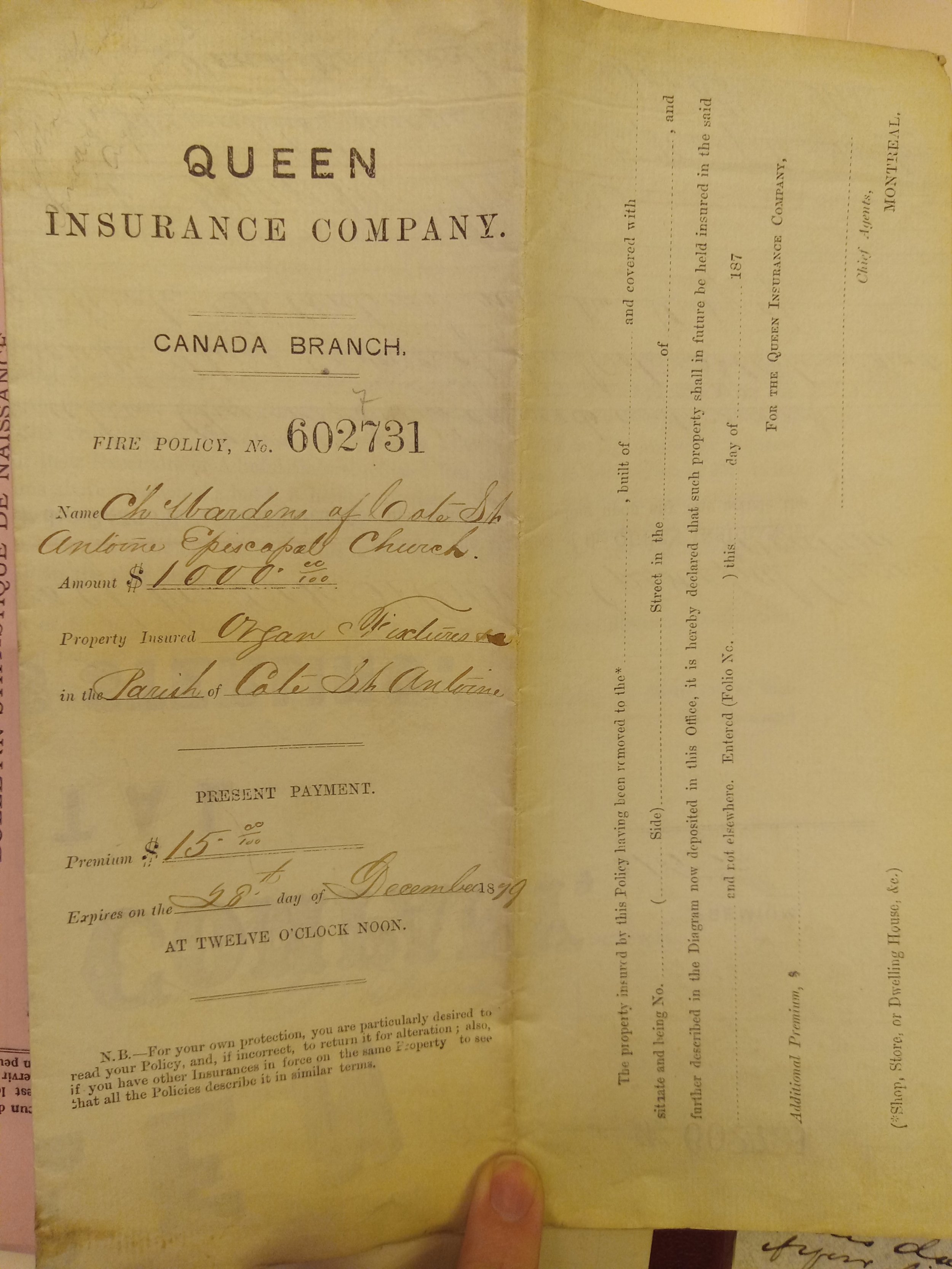

St. Matthias’ was first insured by Queen Insurance Company of Liverpool (whose letterhead boasted “Capital: two millions sterling”) for $1000, at a premium of $15.

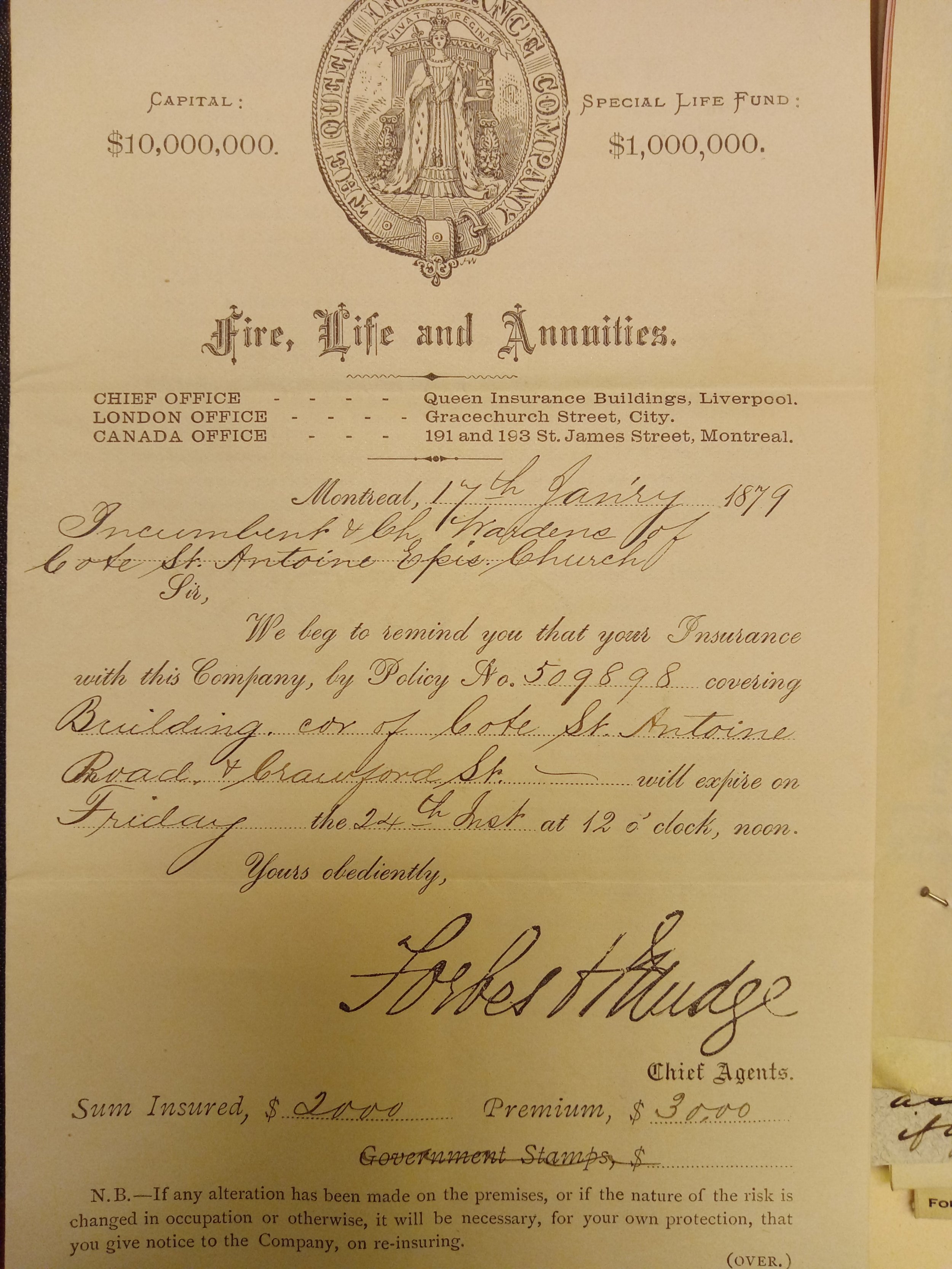

One of the delights of our archives is just how many stories are contained even in non-narrative documents. Today, we dive deeply into the first seventy-five years of insurance, where the documents include beautiful penmanship from the 1870s, a Liverpool connection, the tracks of inflation, and a very Matthian debate over initial outlay vs. long-term savings.

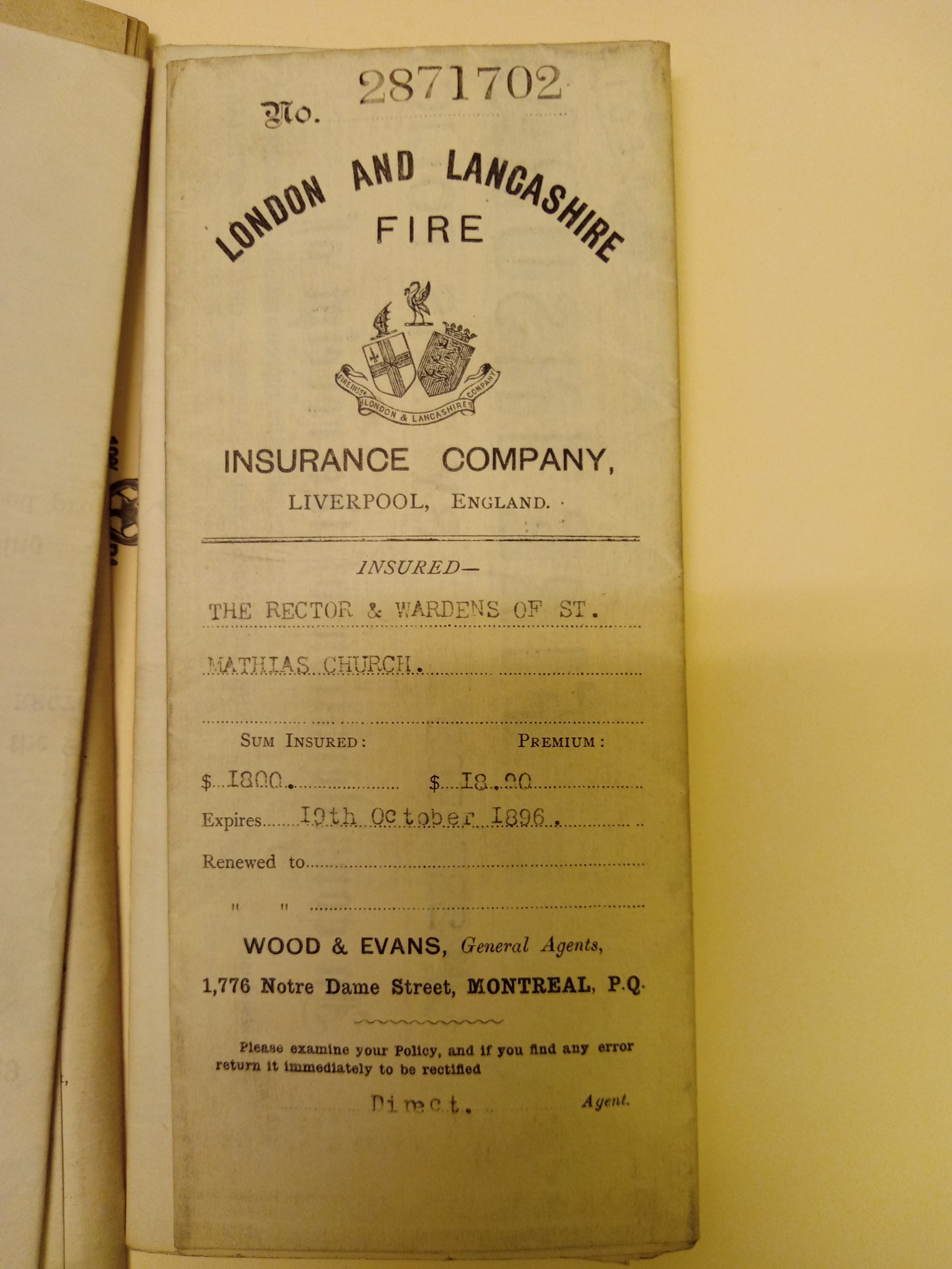

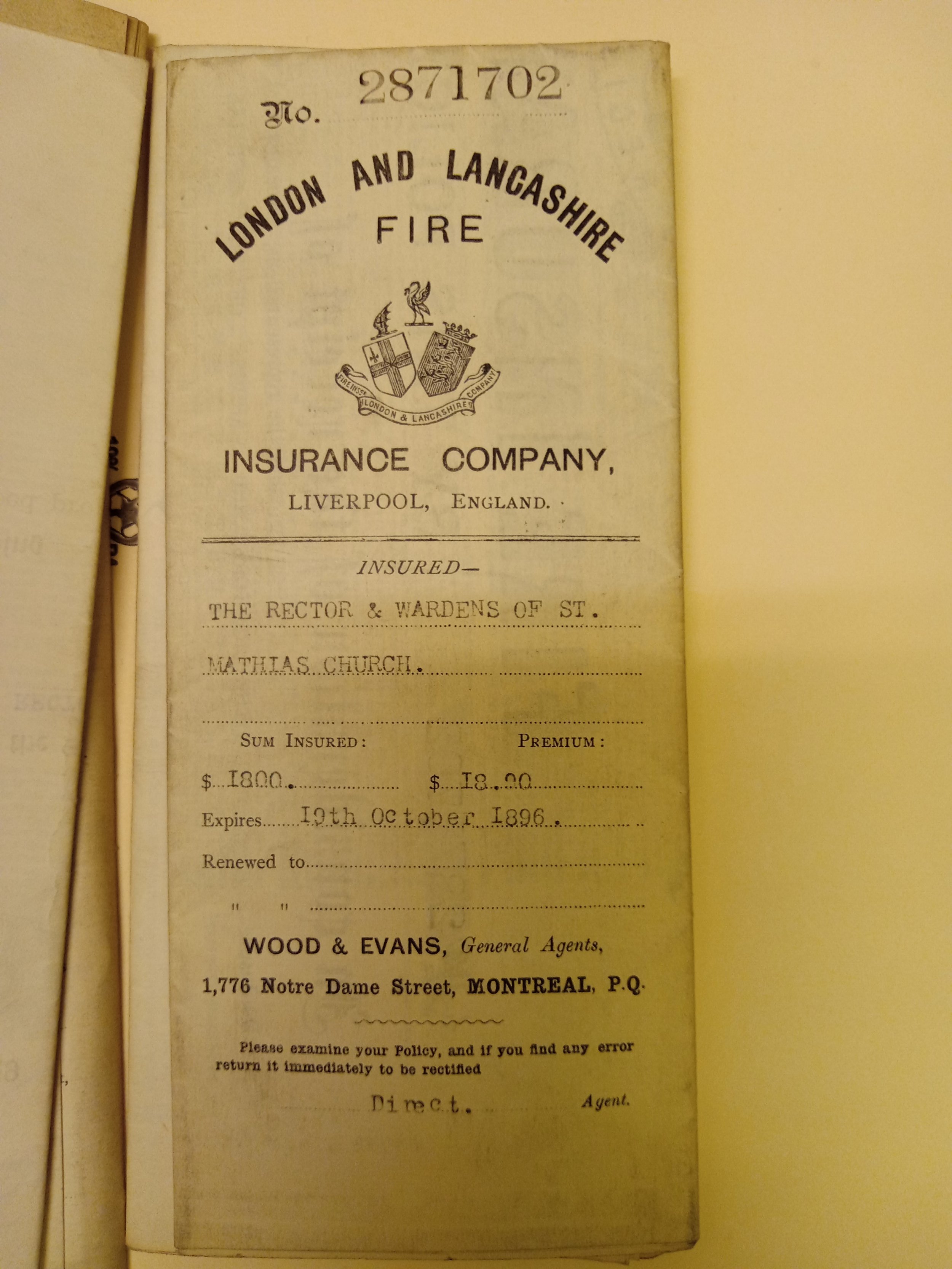

The Queen Insurance Company, who no longer exist but whose building still stands – available for rent as office space! – in Liverpool, renewed St. Matthias’ policy in 1879, with both numbers doubling. By 1896, the London & Lancashire Fire Insurance Company of Liverpool, England, was insuring St. Matthias’ for the princely sum of $1800, with an $18.10 premium. London & Lancashire was a fairly new company, having only been founded in 1862, but it was already on track to becoming one of the biggest insurers in the United Kingdom. St. Matthias’ transition to their portfolio makes sense – London & Lancashire (the locations of the businessmen who helped raise the initial capital for the company) had been working since their inception to acquire Queen Insurance, and had established an agent in Montreal within the first year of their founding.

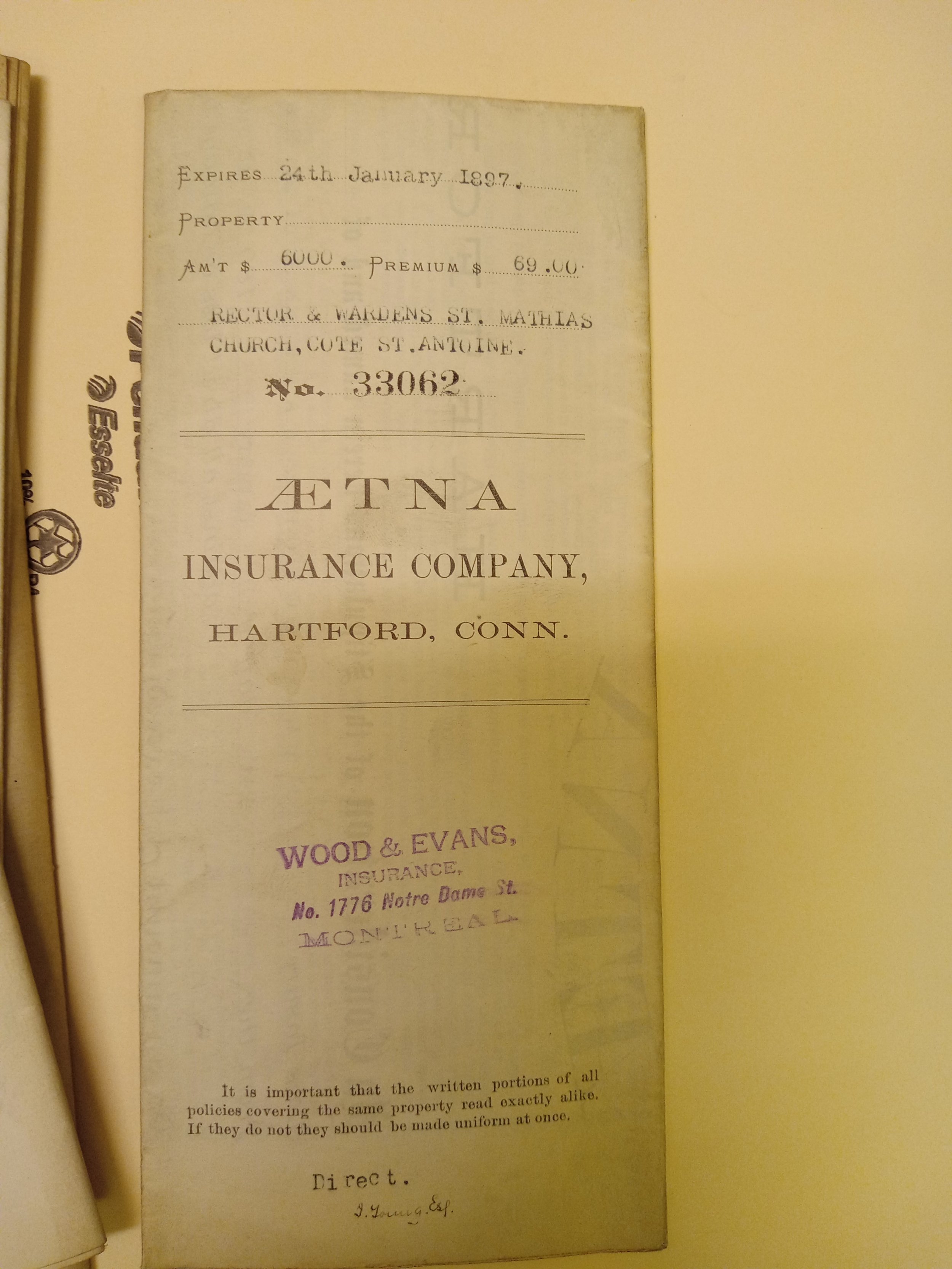

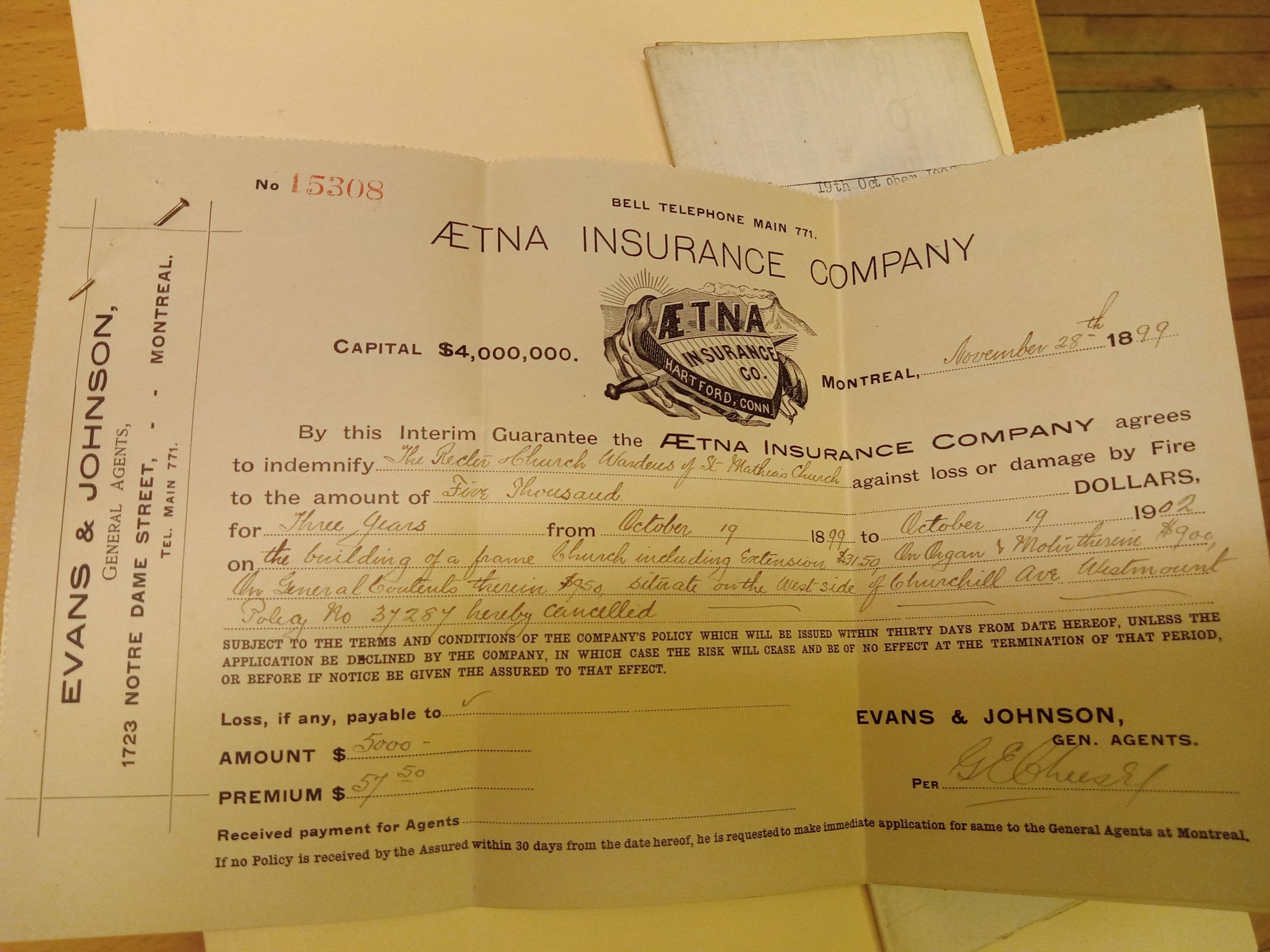

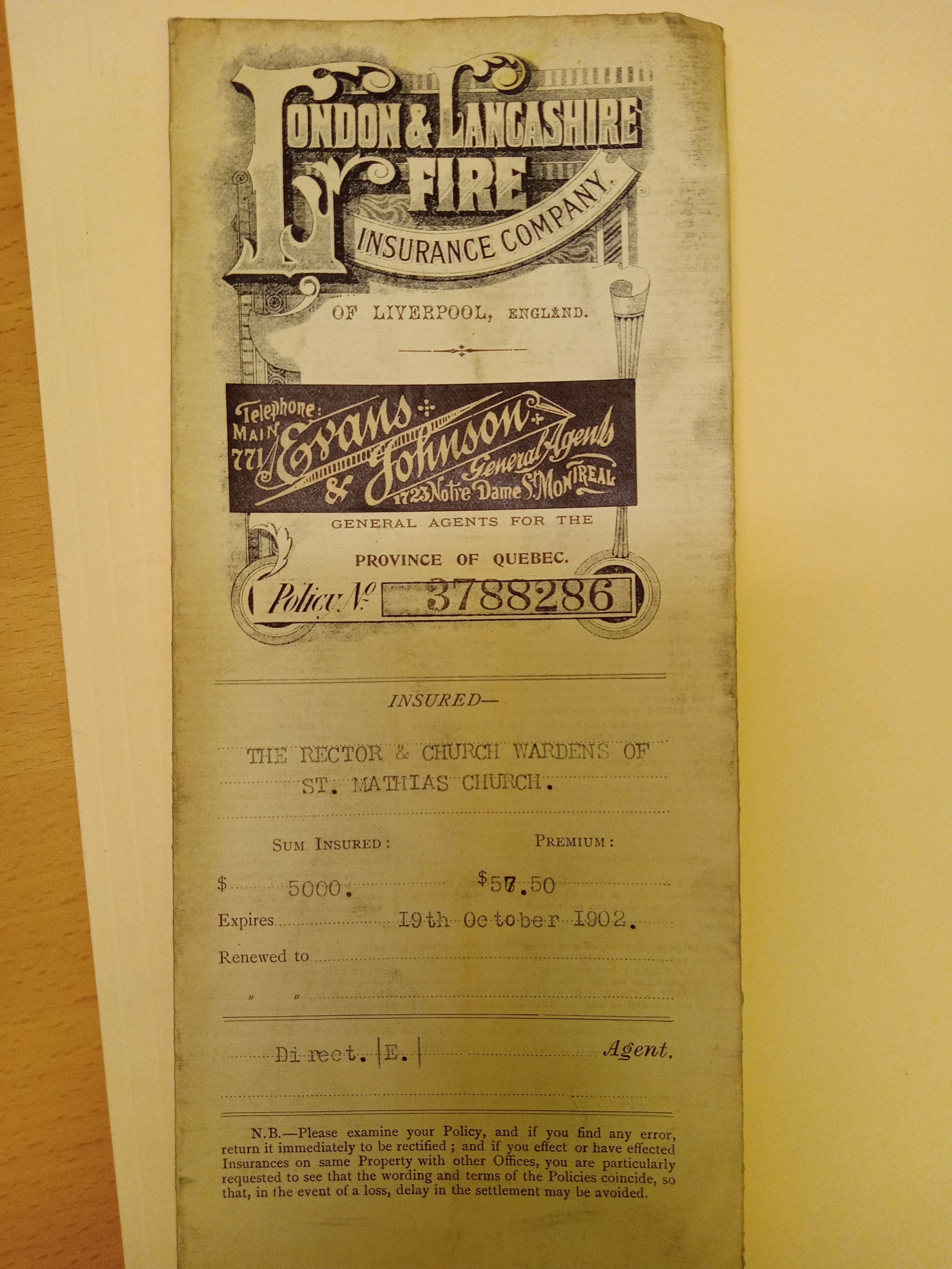

But something about London & Lancashire must have been less than satisfactory – possibly the low coverage they were willing to offer – because Aetna Insurance Company of Hartford, Connecticut, began insuring St. Matthias’ for a much higher sum the following year – a $69 premium for $6000 of coverage. Aetna, founded in 1819, had recently had its capital stake increase from $150,000 to $750,000, and thus must have been an attractive choice indeed. Aetna also has the distinction of being the only one of these early insurers to still exist, albeit only its life insurance arm. In 1899, Aetna again insured the “building of a frame Church including Extensions $3150, An Organ & Moler therein $900, the General Contents therein $950, situated on the west side of Church Hill Ave, Westmount,” “against loss or damage by Fire, to the amount of five thousand dollars,” with a premium of $57.50. Before Aetna’s interim note could turn into a full policy, however, London & Lancashire took over again, and continued to insure St. Matthias’ until 1902 at the same rate that Aetna had given them.

In 1908, the Canadian Branch of the Sun Insurance Office insured St. Matthias’ for $5000, with a cheaper premium of $56.25. Sun Insurance had actually been founded in Montreal in 1865, but expanded rapidly into a global company that would be so successful that in 1918 it could build the Sun Life Building – with its 1933 26-storey addition making it the largest building by square footage anywhere in the Commonwealth.

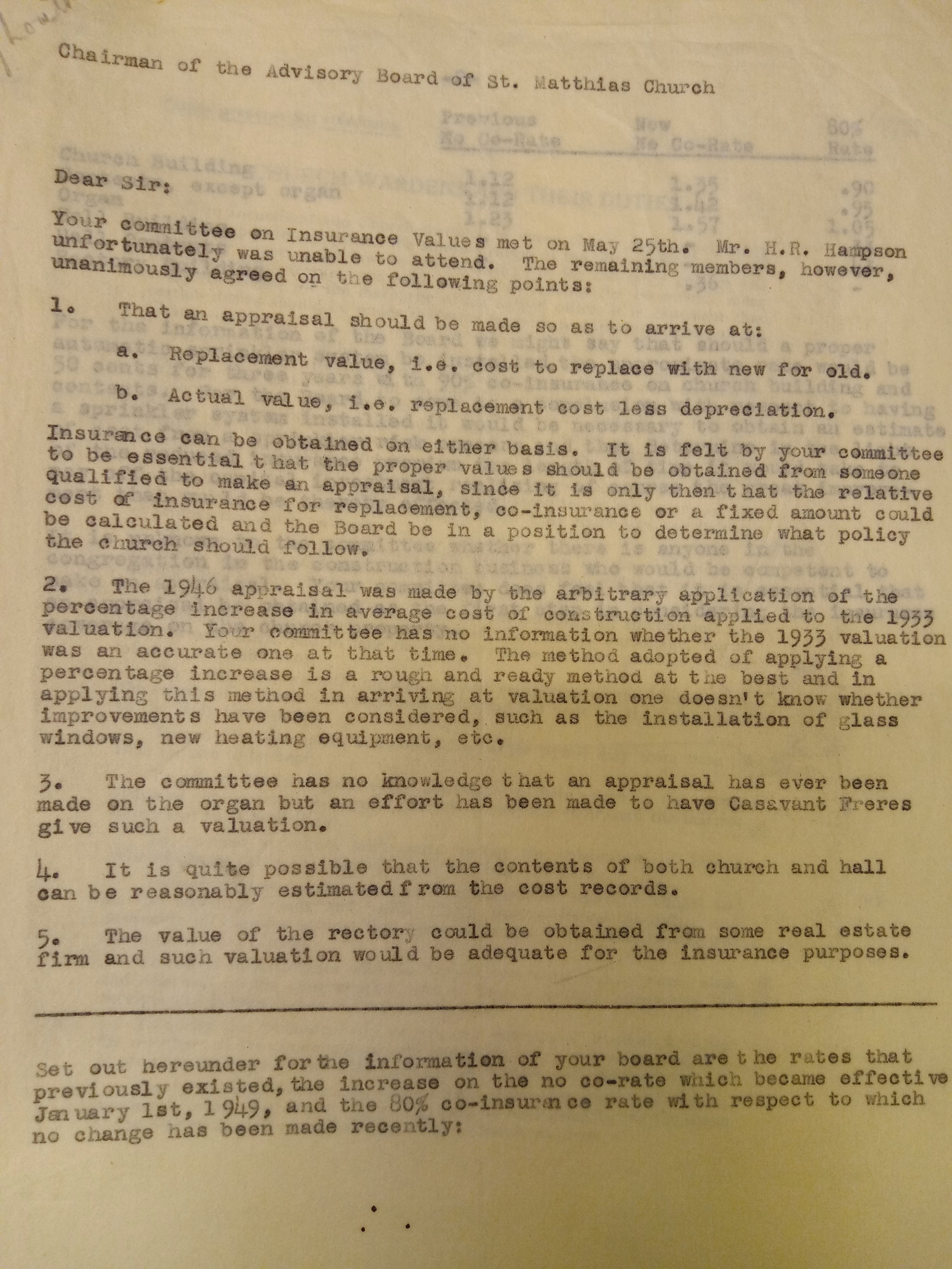

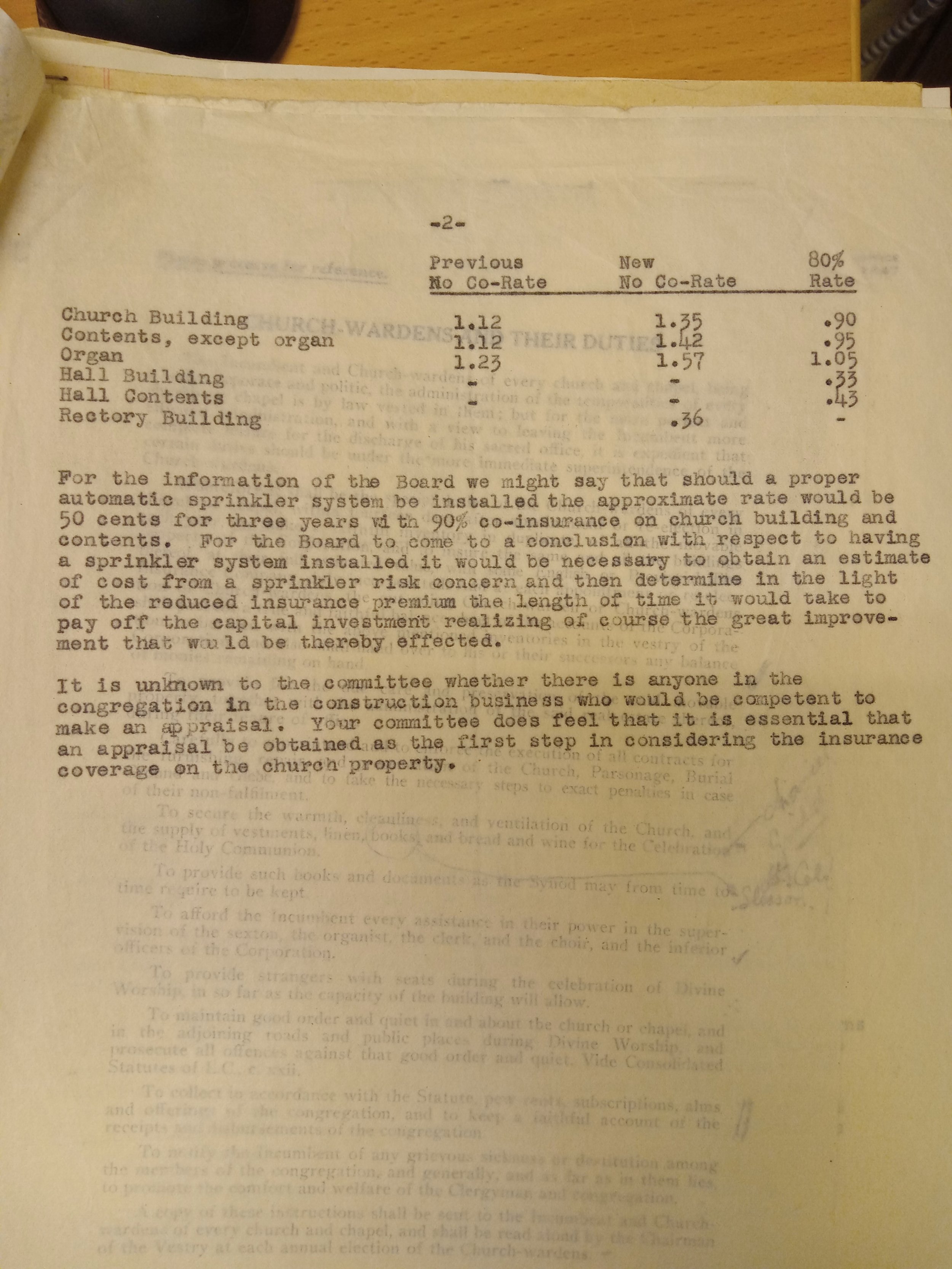

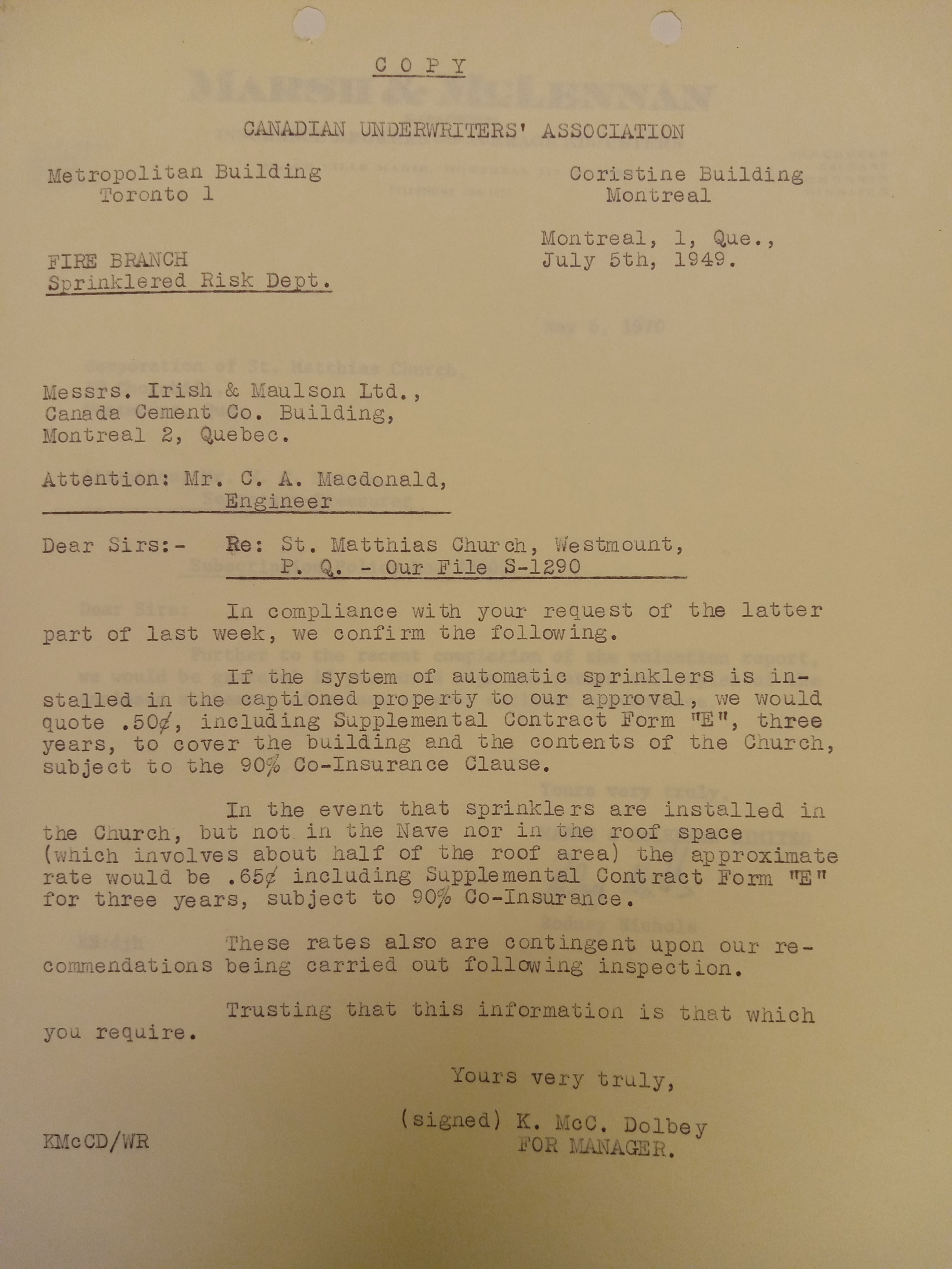

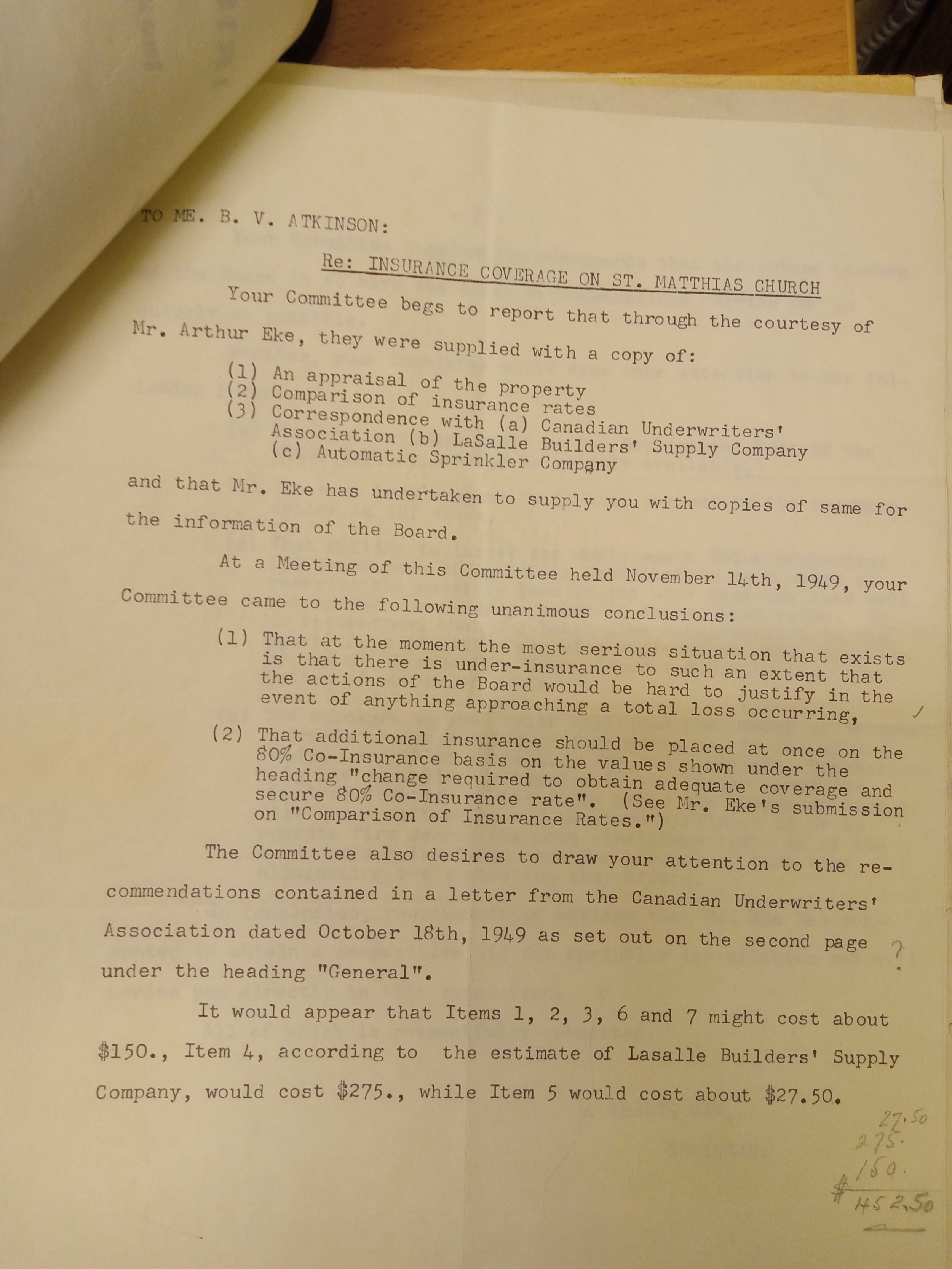

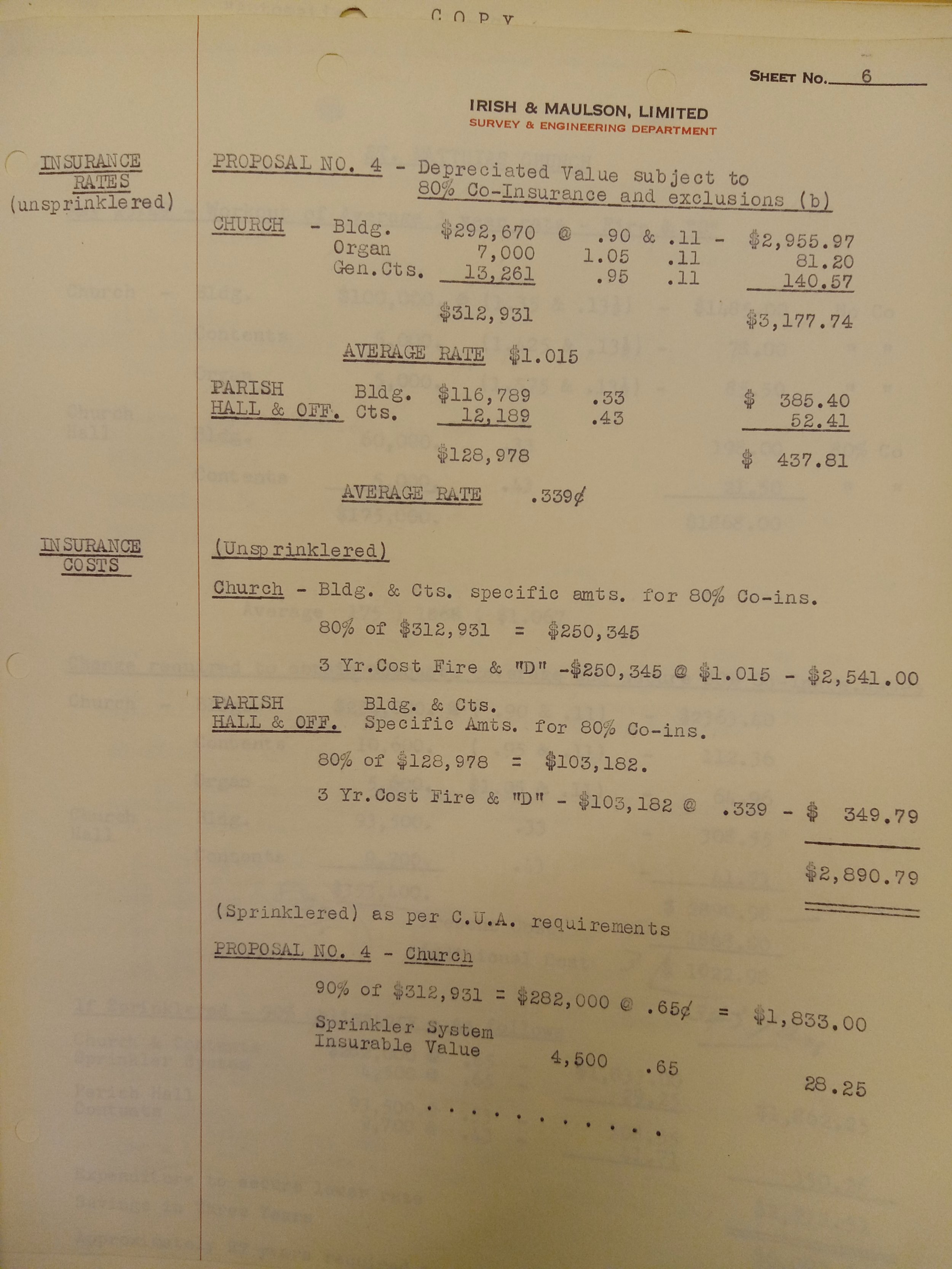

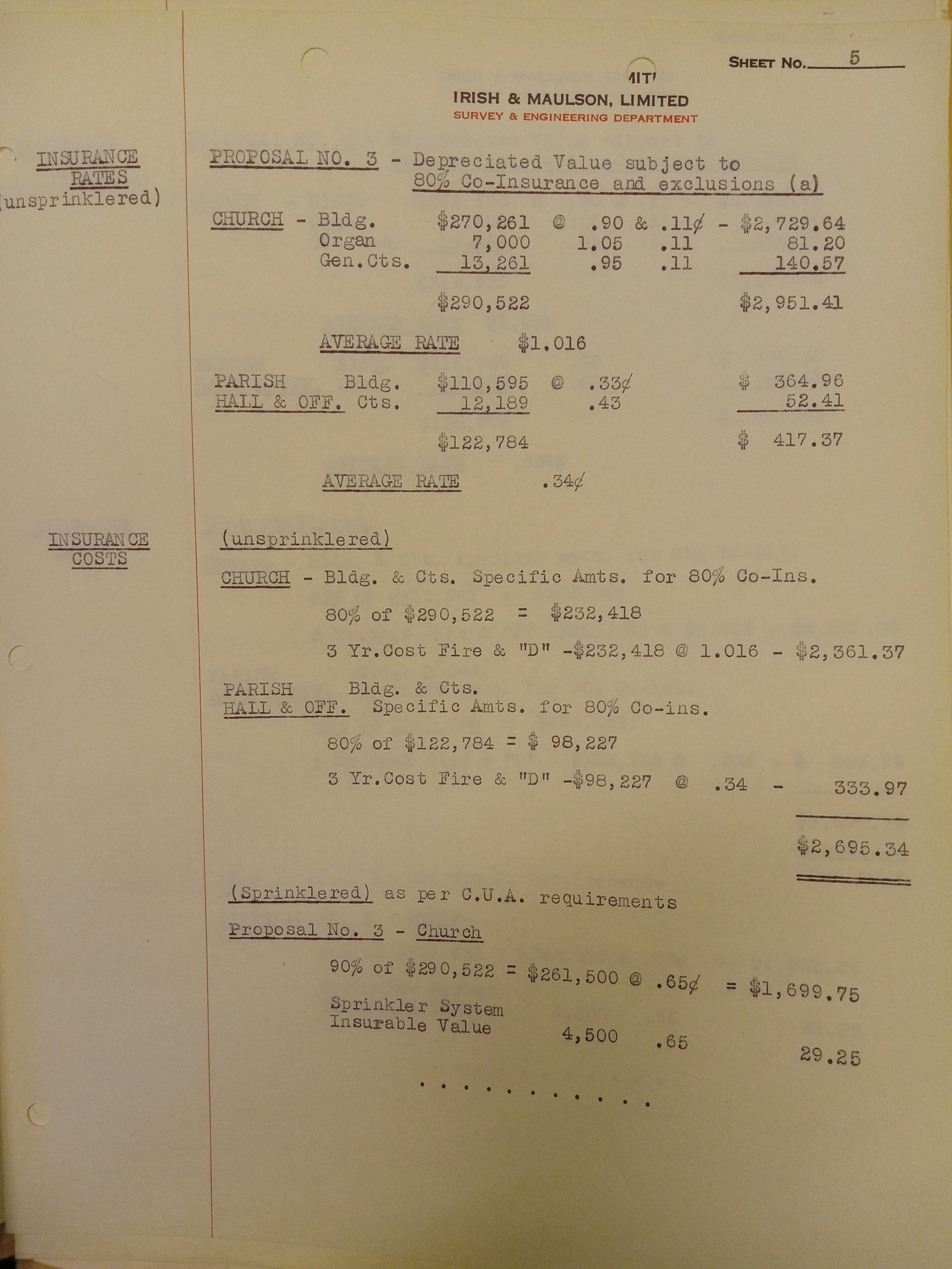

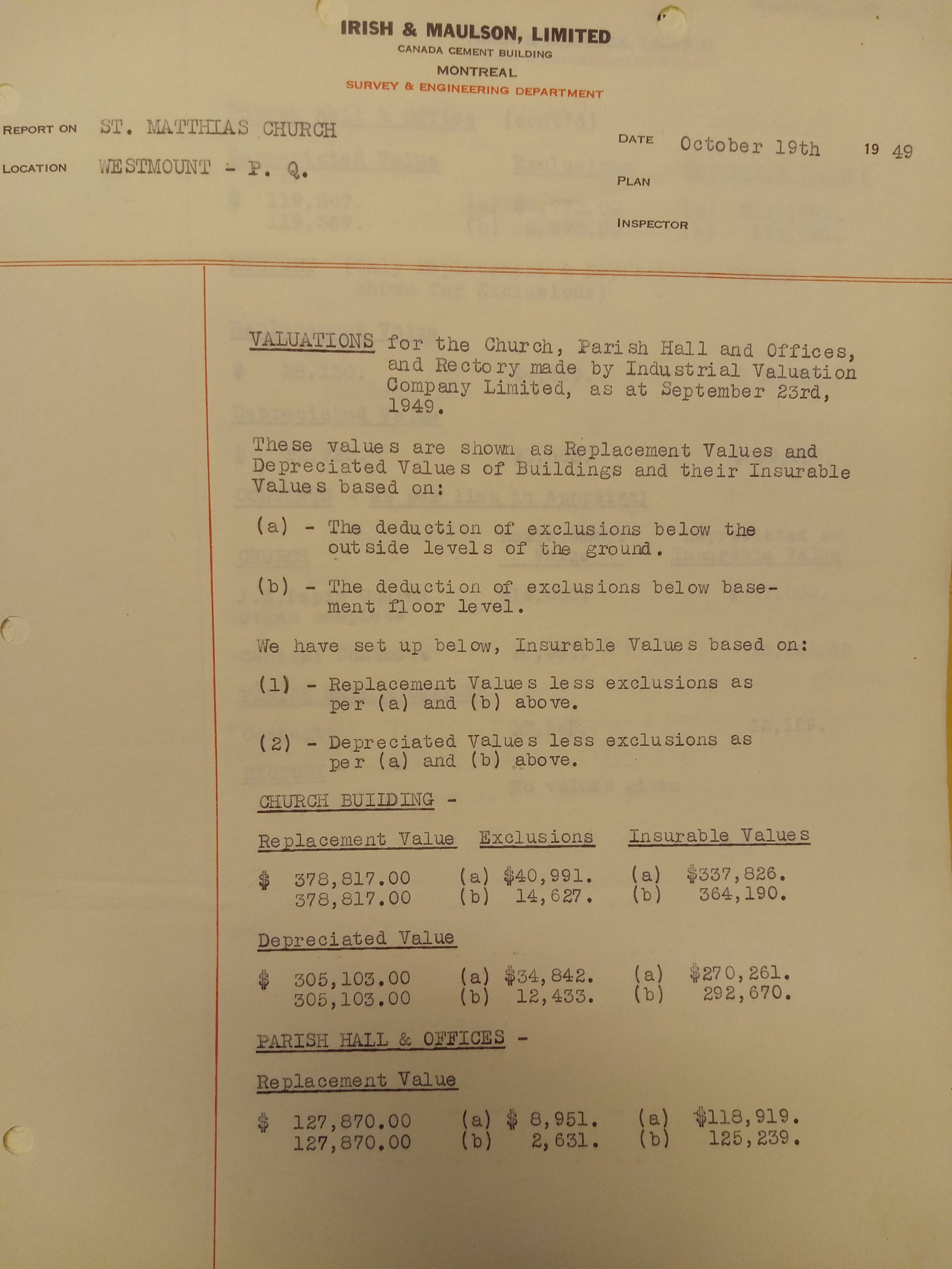

We don’t know how long Sun Insurance continued to insure St. Matthias’, but at some point before 1949, the church changed insurers once again, landing this time with Irish & Maulson, Limited, an Ontario-based firm who had been granted permission to do business in Quebec in 1911. Based on conversations with the broker at Irish & Maulson, one Arthur Eke, in May 1949, the Insurance Committee recommended to the Advisory Board that the building really ought to be appraised, with all its contents, so that both replacement value and actual value of the whole property could be updated. This was essential – the previous appraisal in 1946 had simply applied inflation to the 1933 appraisal – and as for that appraisal, “your committee has no information whether the 1933 valuation was an accurate one at the time.” The 1933 valuation hadn’t included the organ, nor had any previous Insurance Committee considered mitigation measures. The report suggested that the installation of a sprinkler system might reduce the insurance rate, but it would be unclear by how much before July 1949, when the Canadian Underwriters’ Association, founded in 1883 to harmonise Canadian insurance provision across the country, provided Arthur with its best practices.

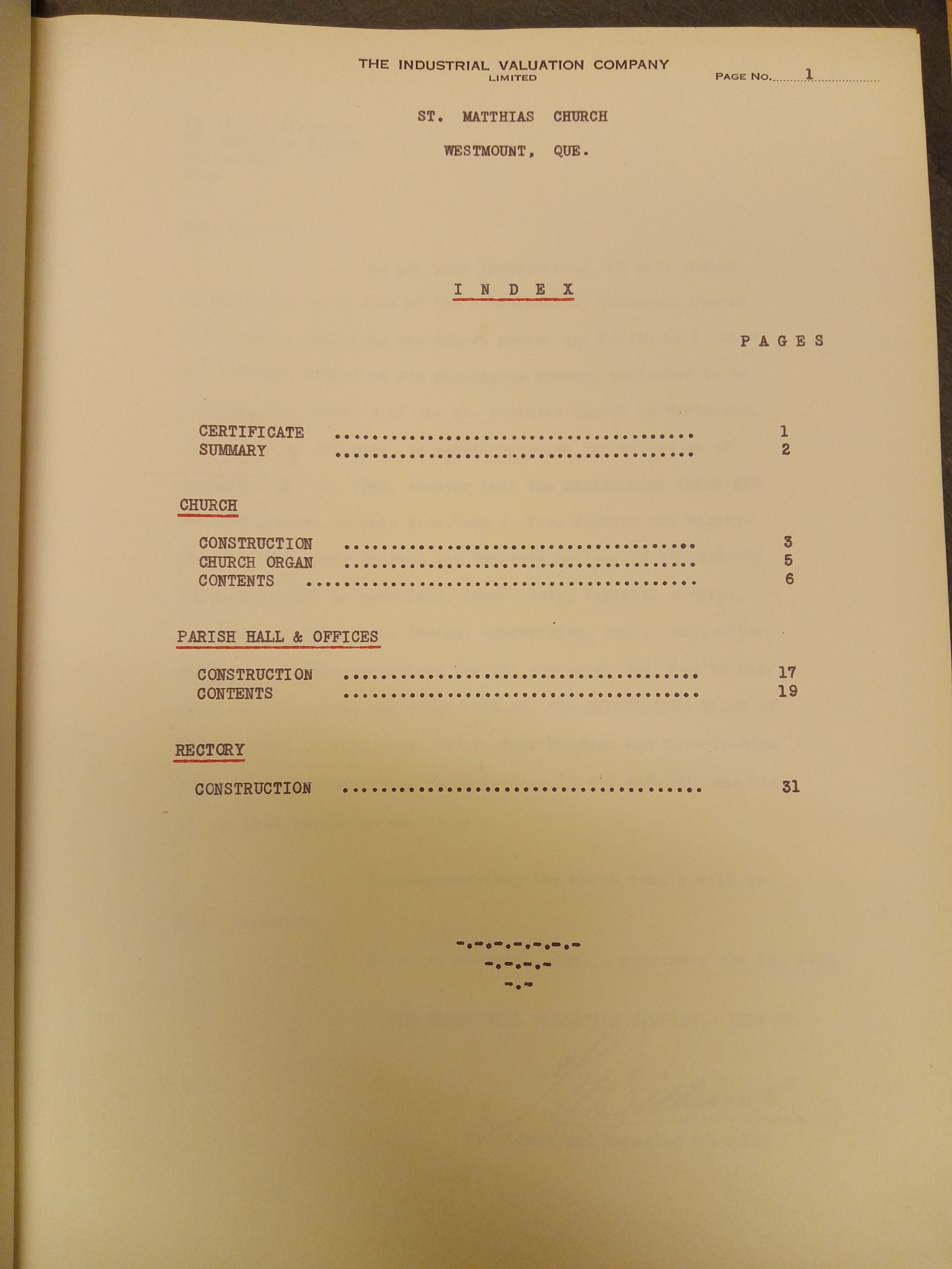

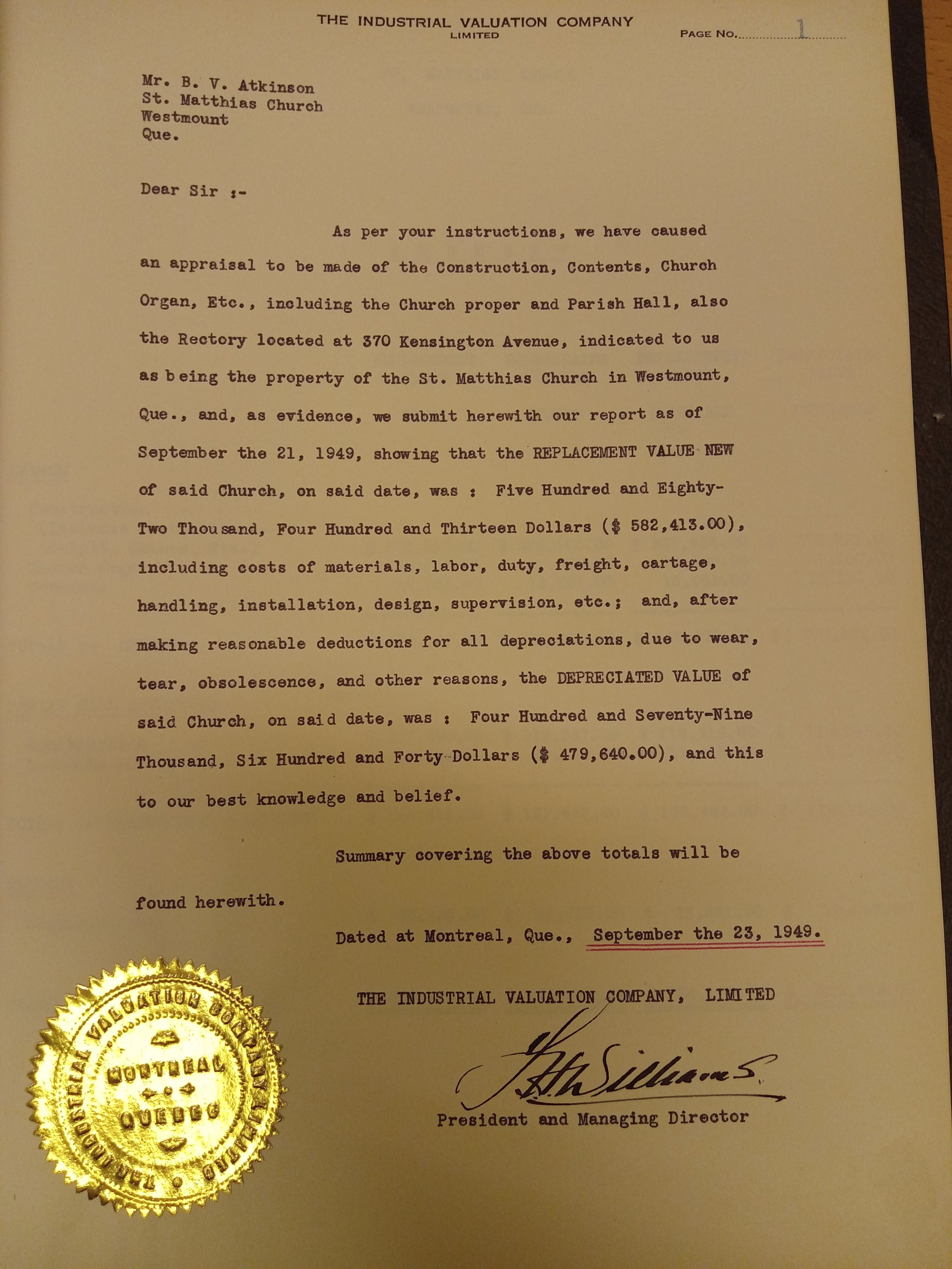

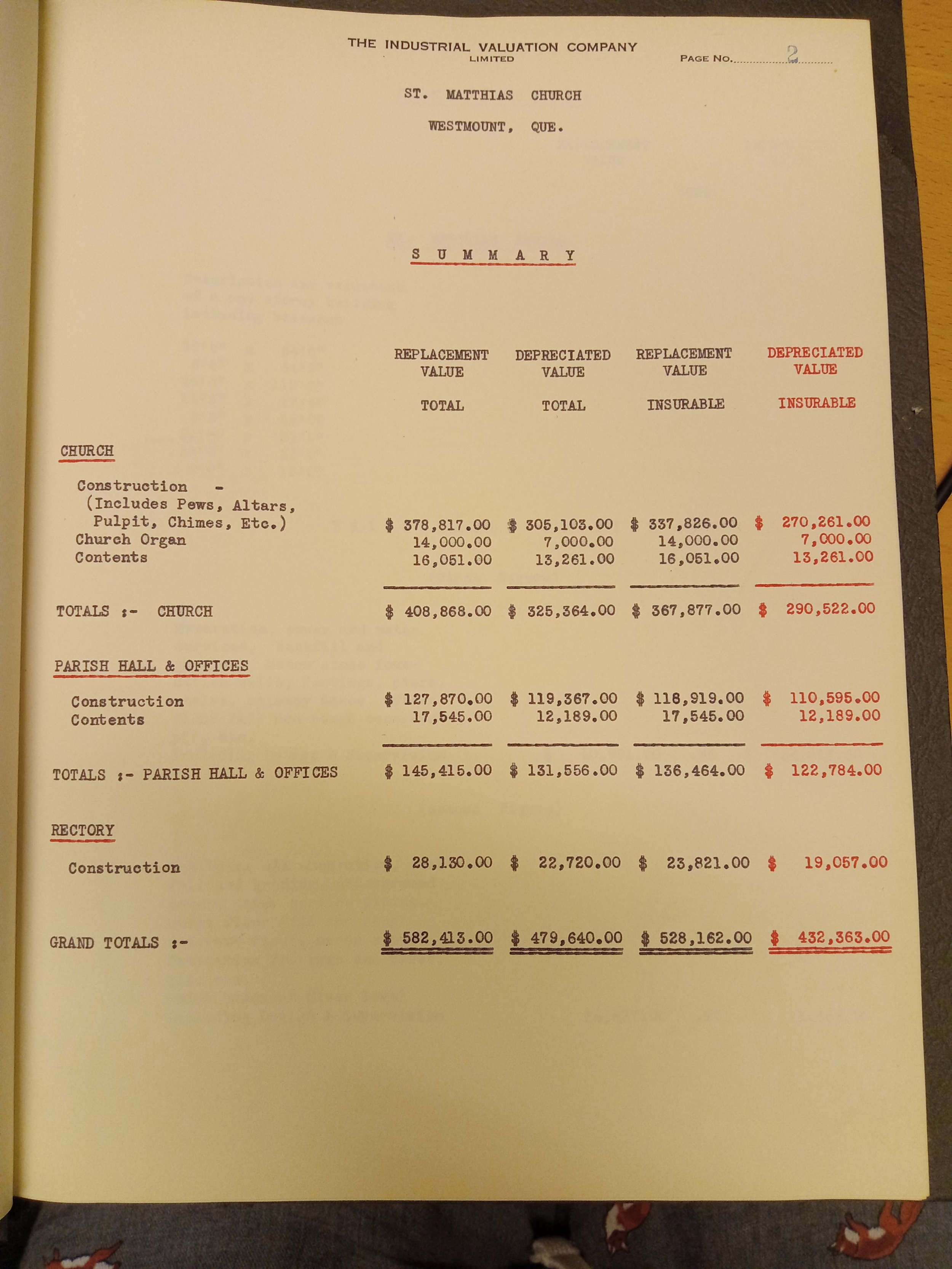

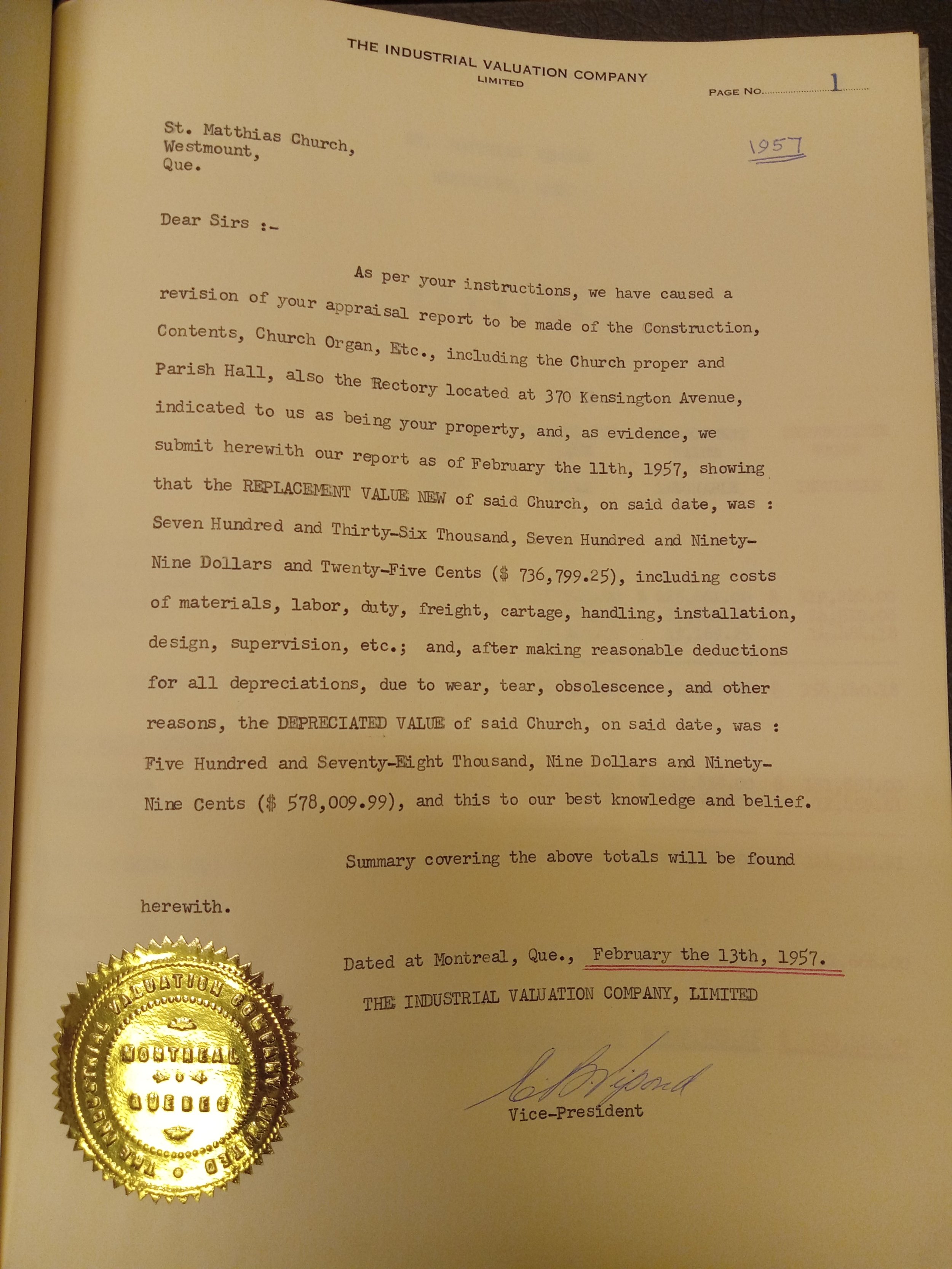

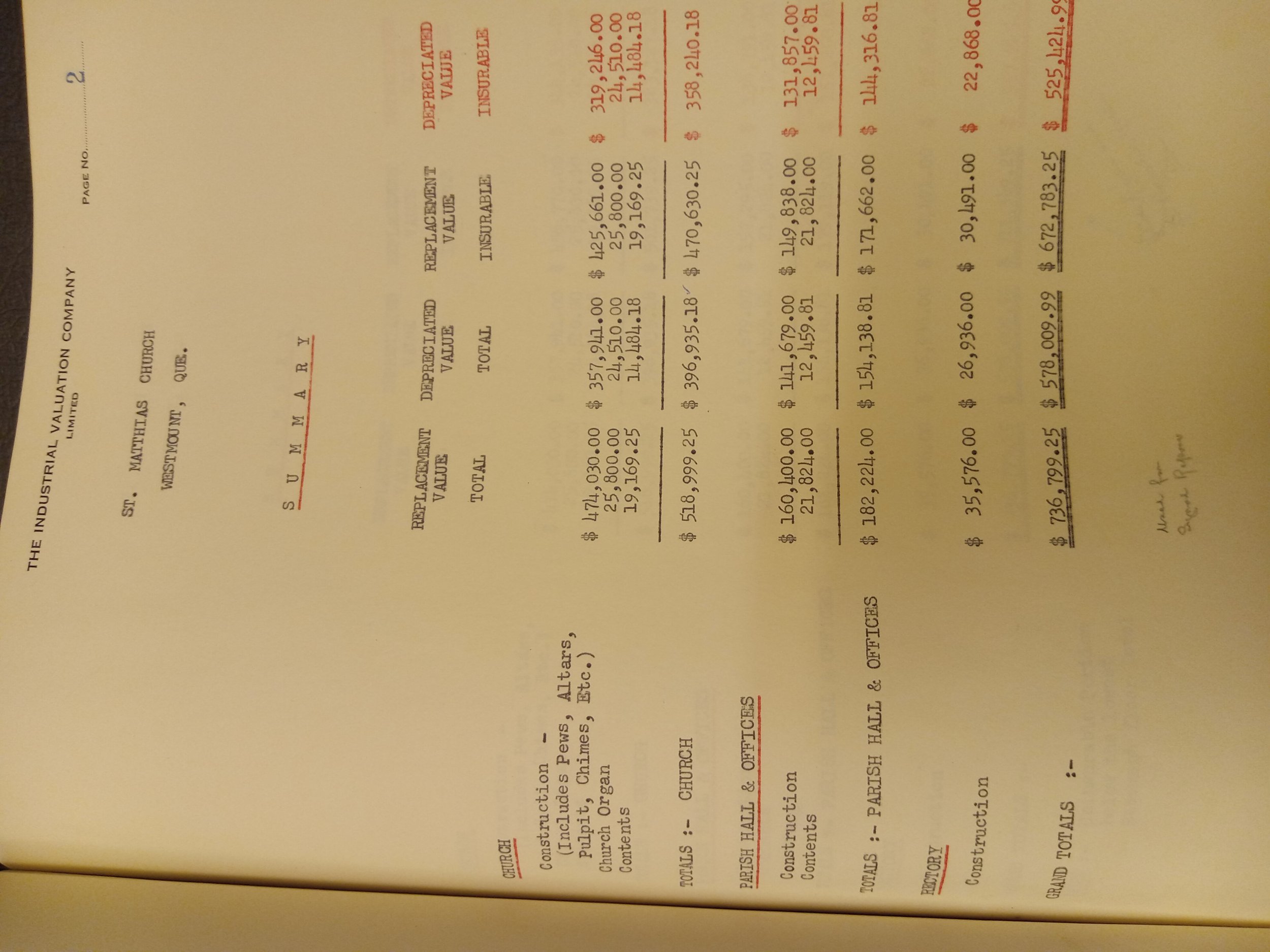

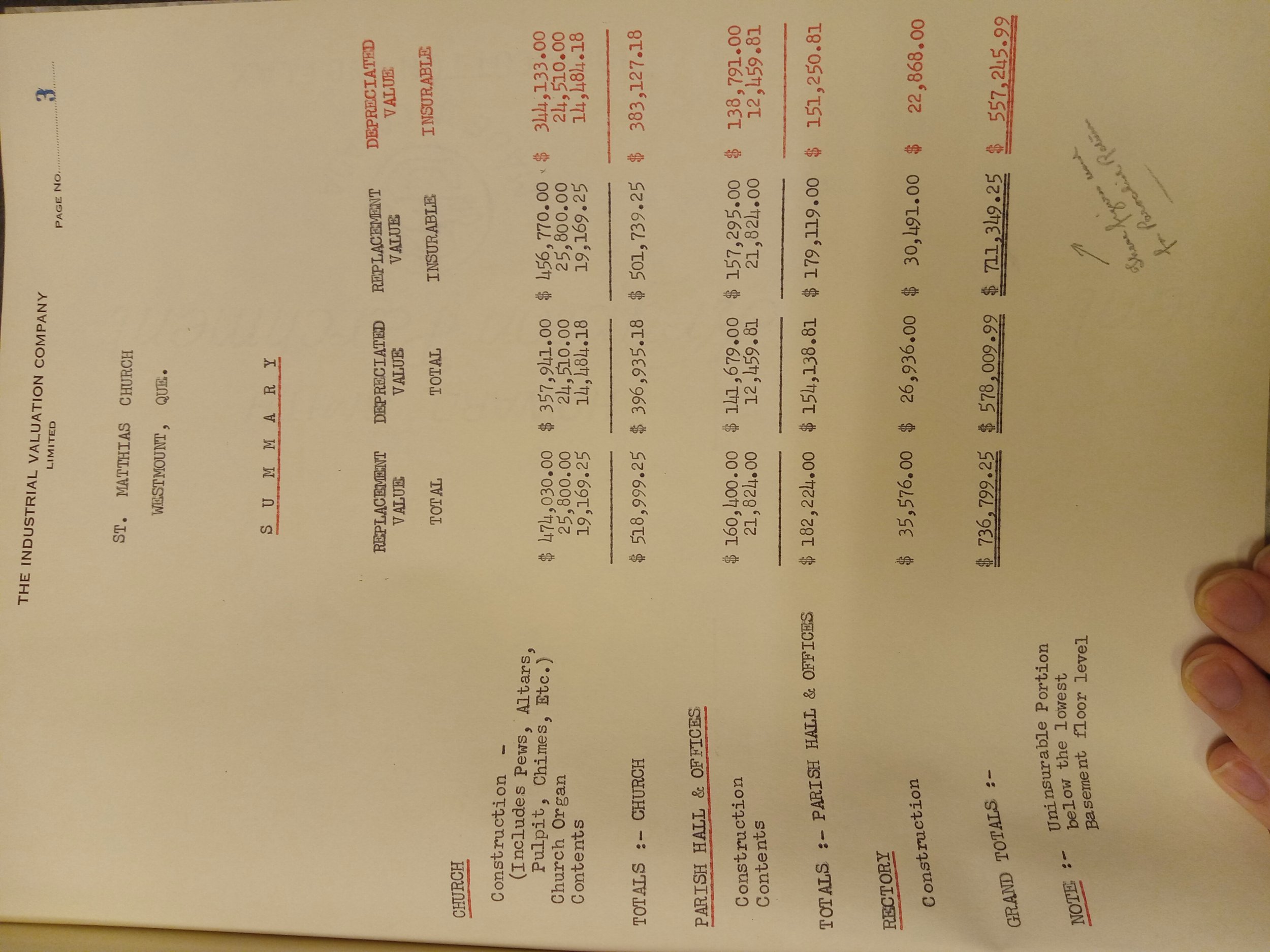

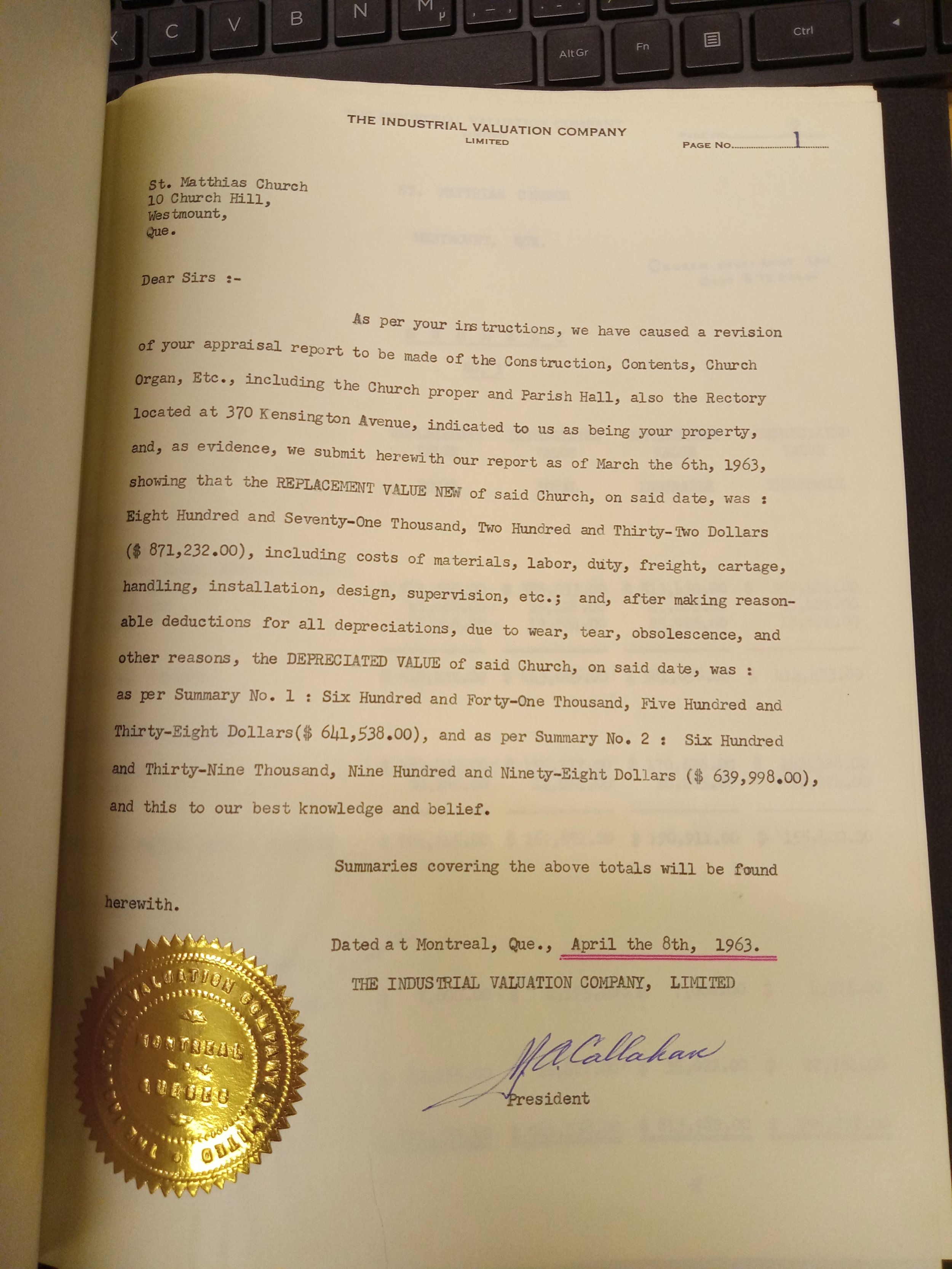

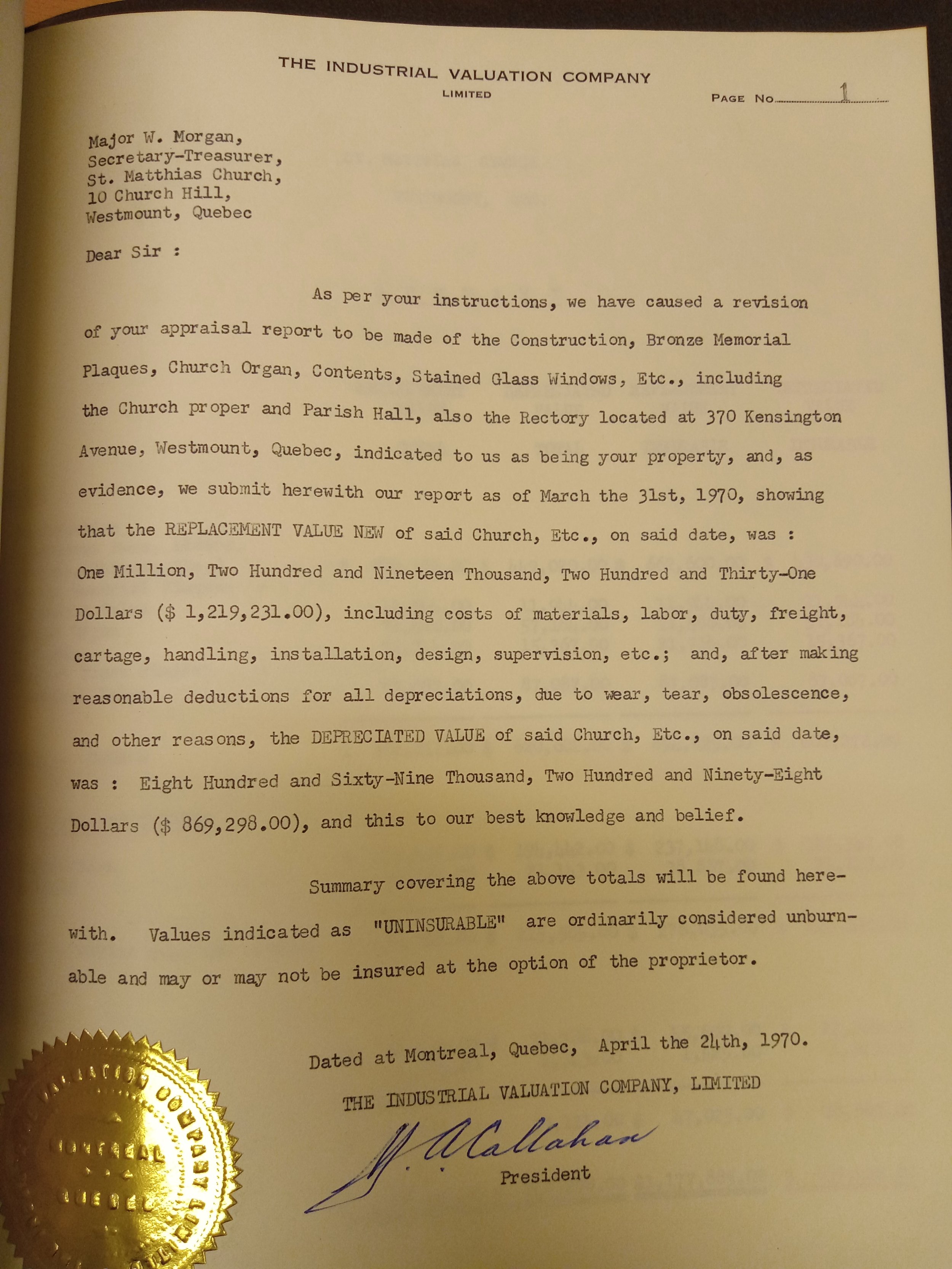

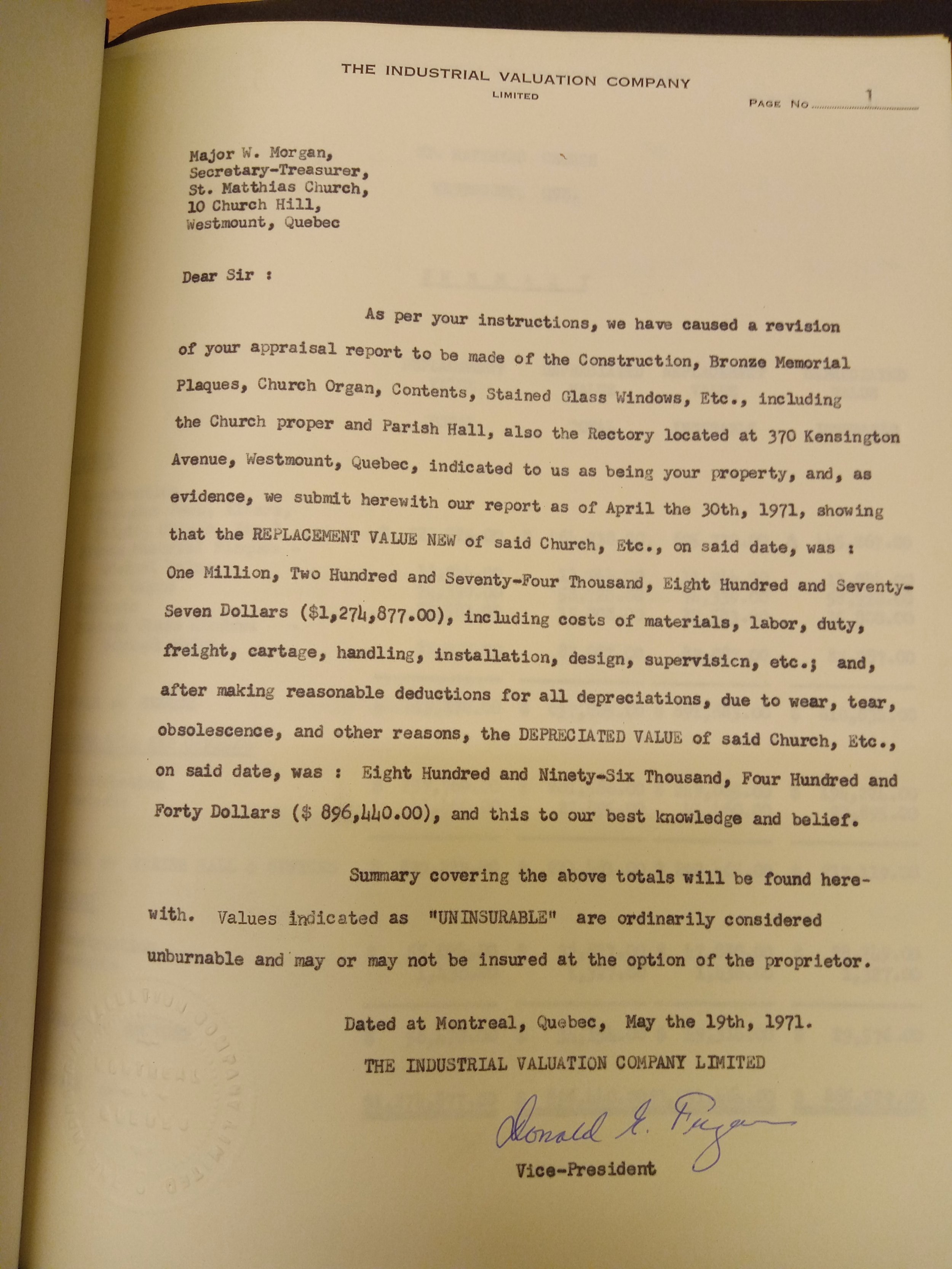

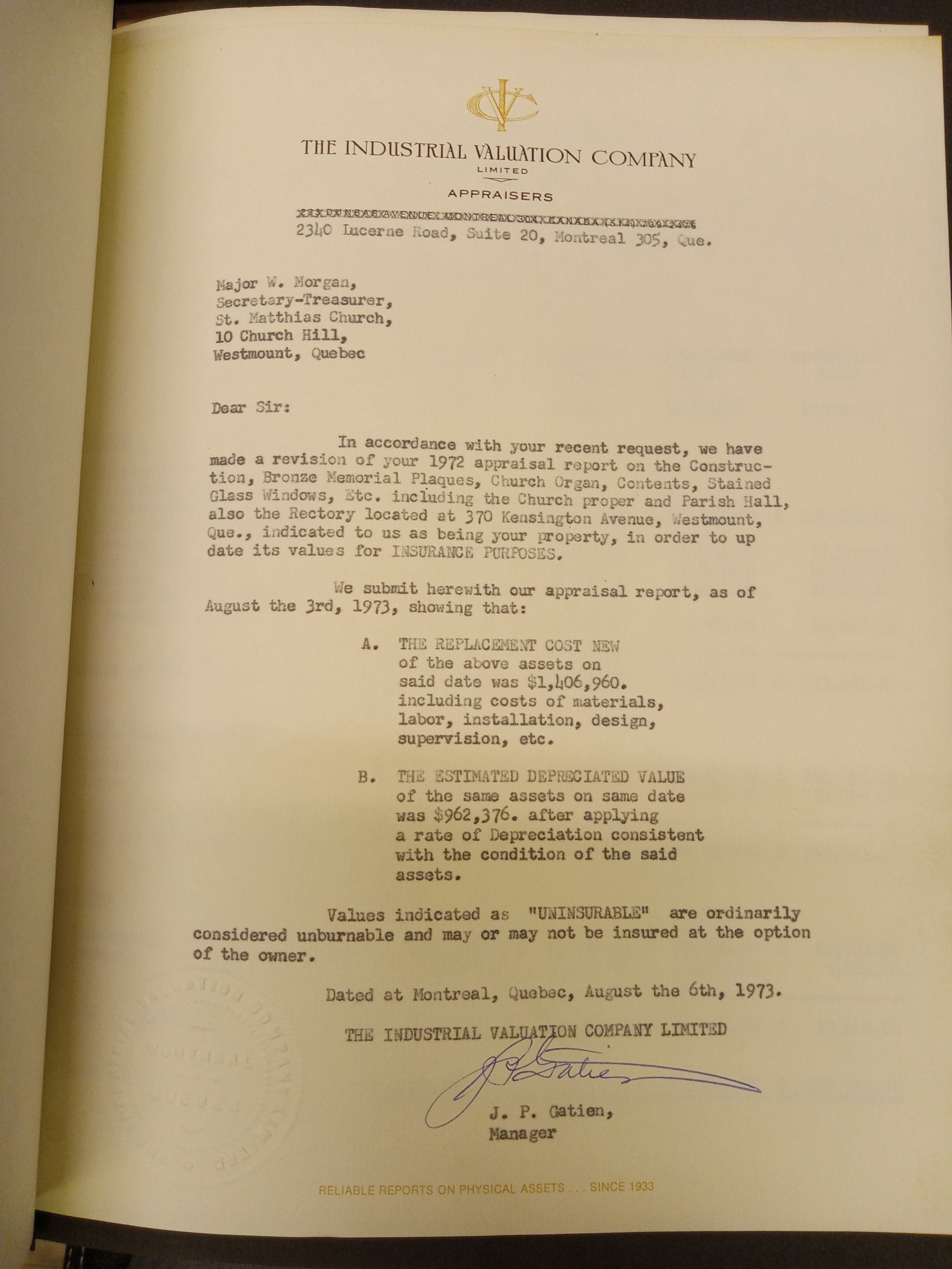

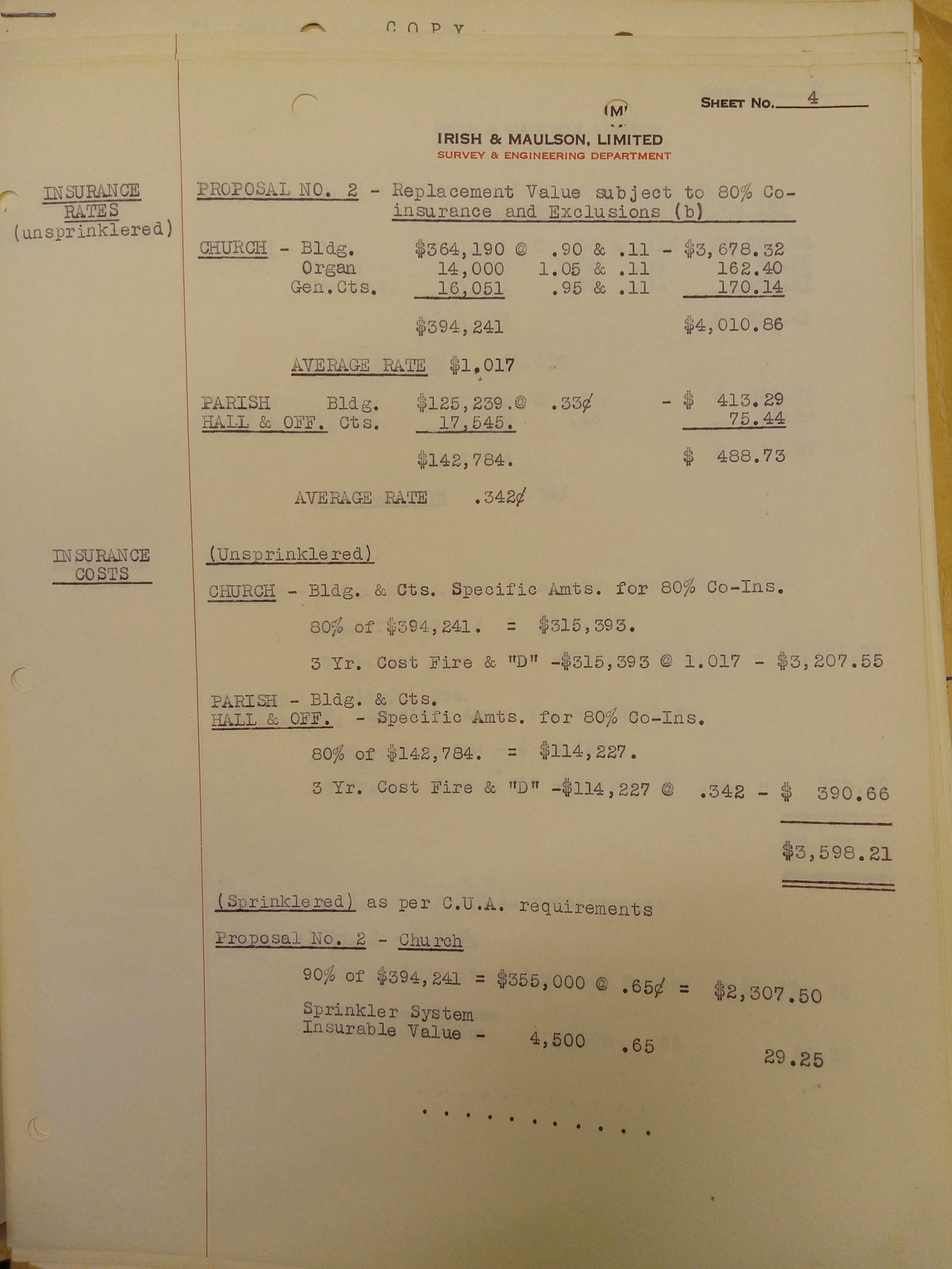

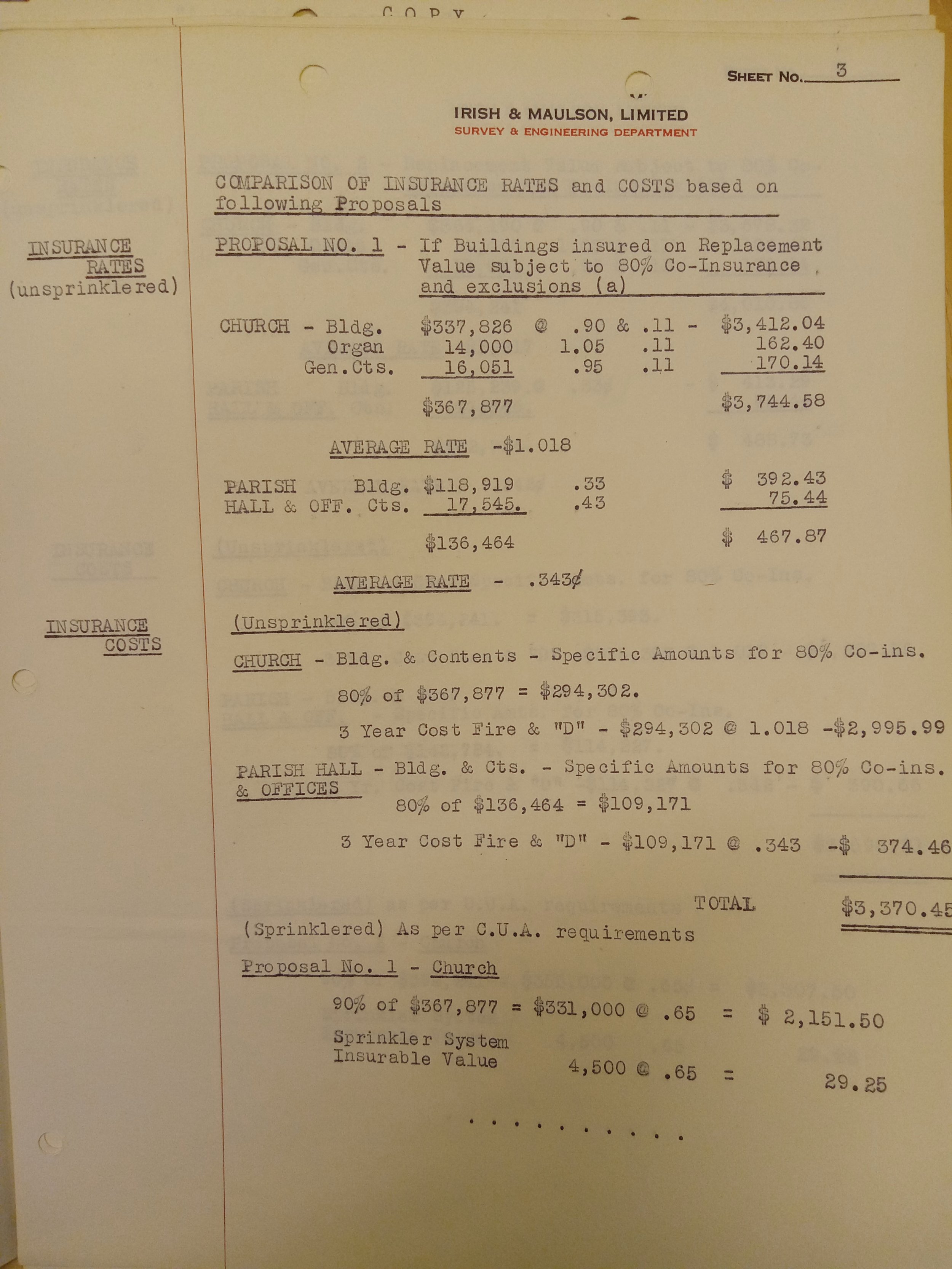

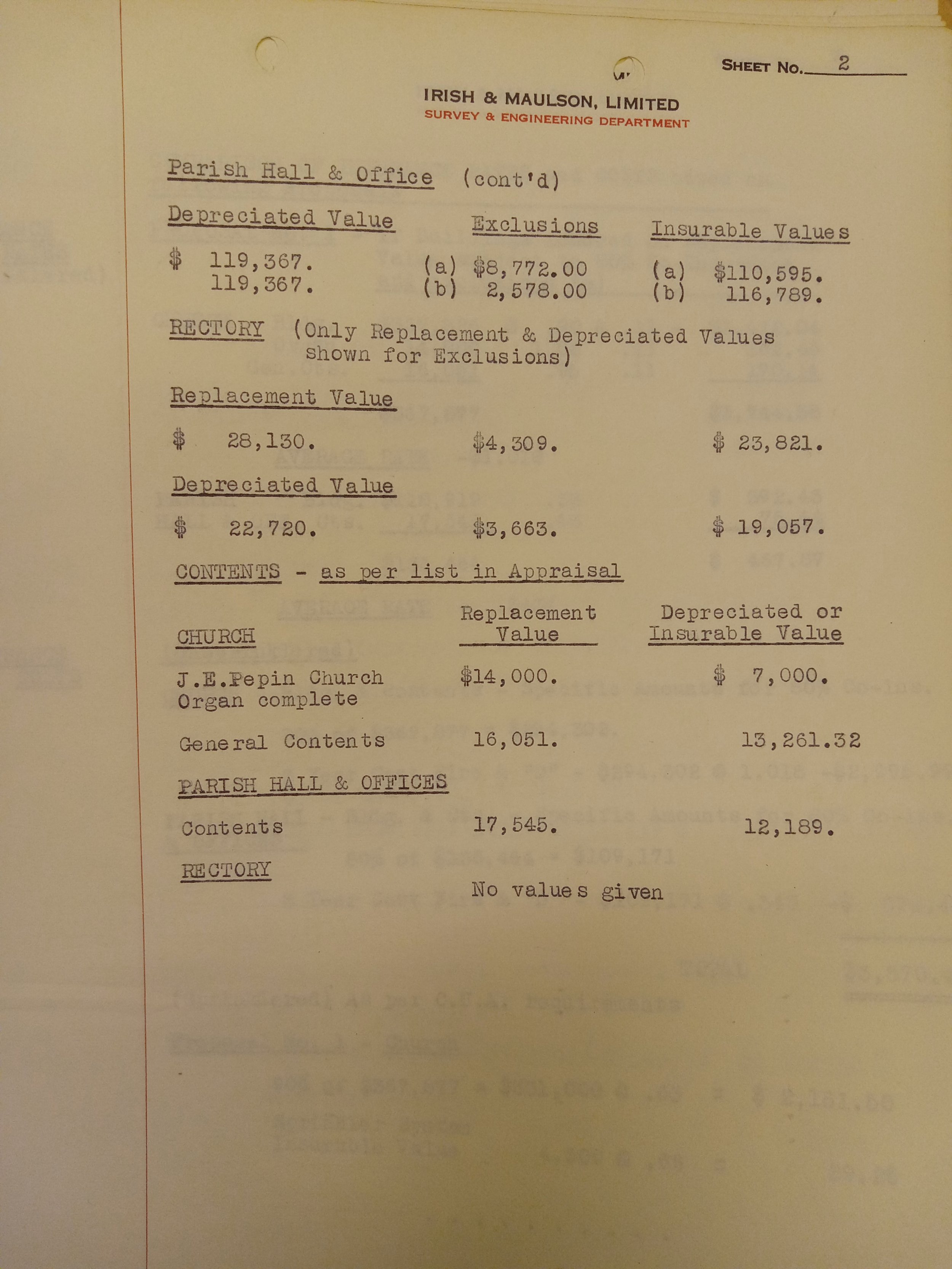

Thus began the first of several re-valuations of the property conducted by the Industrial Valuation Company, a Montreal firm. In September 1949, they appraised the replacement value of St. Matthias’ holdings, including the Church, the Hall, and the Rectory, as $582,413. Their report, which you can see in the images above, is thorough and precise, showing not only the replacement and depreciated value for everything, but also what portion of that value would be insurable. They would repeat these reports in 1957, 1963, 1970, 1971, and 1973, by which time the church’s replacement value had climbed to $1,406,960. Such were the fortunes of the parish that they commissioned IVC to complete a valuation yearly, for an annual fee of $135, which IVC would directly transmit to the insurers in advance of the policy renewal date.

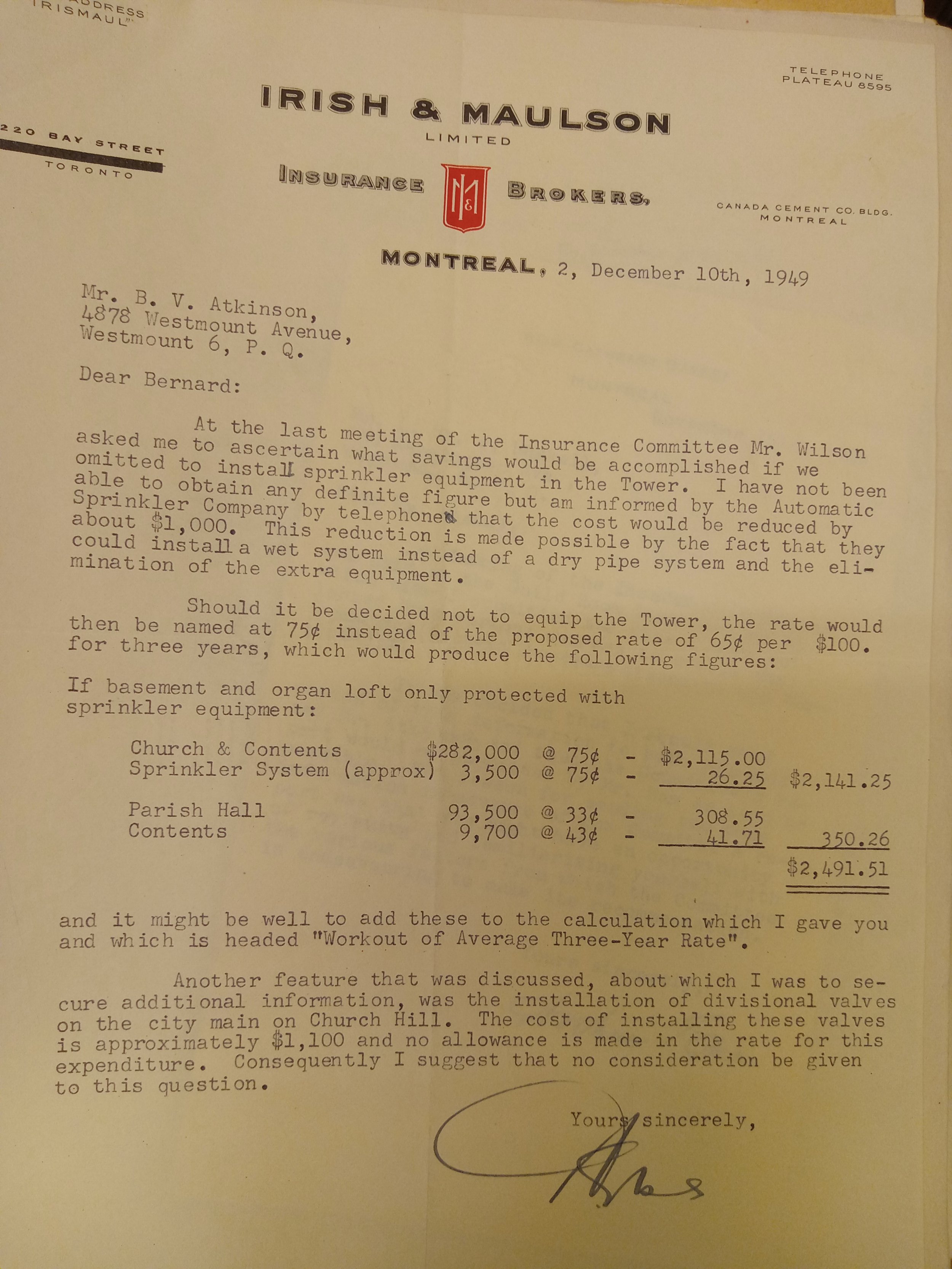

Near the end of 1949, this building assessment prompted a significant revision of the insurance policy. A. Leslie Ham, the chair of the Insurance Committee, reported to the St. Matthias’ Advisory Board that “at the moment the most serious situation that exists is that there is under-insurance to such an extent that the actions of the Board would be hard to justify in the event of anything approaching a total loss occurring.” Arthur Eke took charge of amending the insurance policy based on the Canadian Underwriters’ Association’s recommendations, corresponding not with Ham, but with Bernard Haskell, the Rector’s Warden at the time. The Insurance Committee strongly recommended that the installation of a sprinkler system also be adopted as a means of mitigating risk and thus lowering overall insurance premiums.

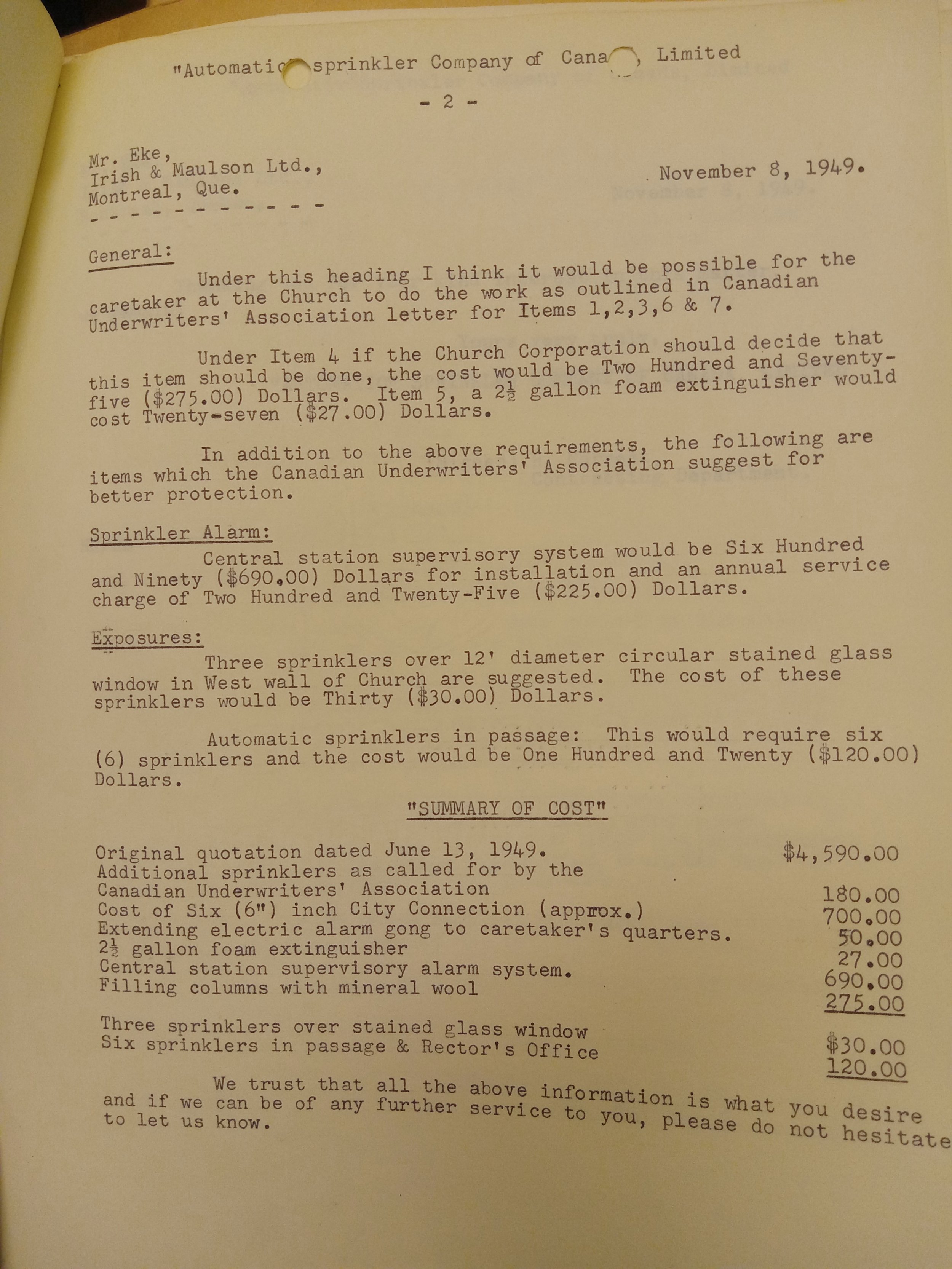

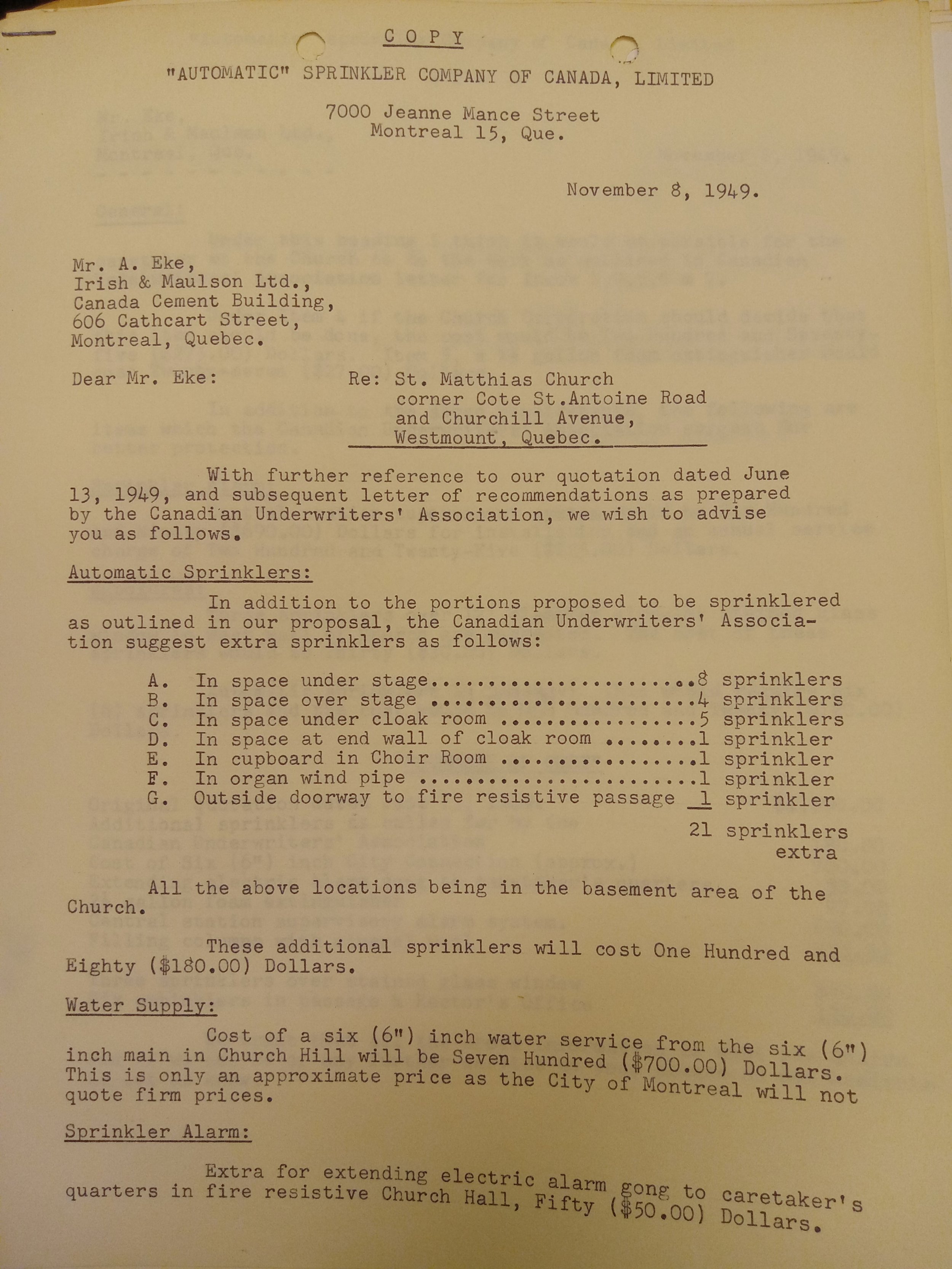

Over the following months, Arthur and Bernard worked to find a happy medium between lowered premiums and the up-front cost of sprinklers. The “Automatic” Sprinkler Company of Canada suggested that if installation was taken care of in-house, their price would drop from their initial quote of $4590. But, they also noted, the CUA had reviewed the initial quote and recommended additional sprinklers, raising the price again by several hundred dollars. We have no documentation about the final decision – who made it, what the final price was, and how much was knocked off the insurance premium as a result – but we do have a sprinkler system in the current church, and it is possible that it was first installed in early 1950.

This was timely, as the Diocese of Montreal’s Executive Committee also met in November 1949 to discuss the possibility of a group policy for all the churches in the Diocese, and St. Matthias’ was able to give all the desired details very quickly. We do not have insurance policies in our archives after 1949, so it is possible that the Insurance Committee opted for the much more reasonable group policy that year. Whether they did, or kept going on their own a little longer, in St. Matthias’ currently benefits from the Diocese’s policy. While our current insurers don’t require full valuations of the building, keeping our inventory updated is part of ensuring that everything we might want to replace in case of disaster is documented so that it can be covered.